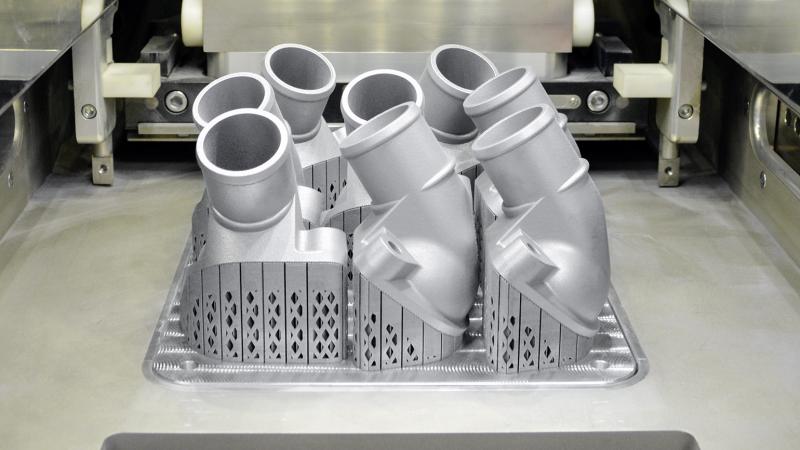

![3D printed aluminum parts [Source: Mercedes-Benz Trucks ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb08f8029445.jpg) 3D printed aluminum parts [Source: Mercedes-Benz Trucks ]

3D printed aluminum parts [Source: Mercedes-Benz Trucks ]

Charles Goulding and Peter Favata of R&D Tax Savers discuss the place of 3D printing in the face of tariff exemptions.

A September 23rd Wall Street Journal article indicates that Arrowhead Engineered Products (Arrowhead) of Minnesota has filed 10,000 tariff applications to obtain relief from Chinese tariffs on parts imports. Arrowhead sells parts for the following end-uses: power sports (such as dirt bikes and ATVs), automotive and heavy-duty trucks, and outdoor power equipment, as well as agriculture and industrial. Some of their parts include pistons, gaskets, camshafts, electrical products, and replacement parts for agriculture and construction equipment.

Arrowhead’s parts volumes should present the 3D printing industry with a great opportunity to produce 3D printed parts from local suppliers in Canada and the U.S.

The WSJ article goes on to say that it is very difficult for experts to evaluate the U.S. government’s criteria for granting tariff exemptions. Perhaps one criterion should be whether a reasonably priced 3D printed substitute part is available from a more local supplier.

U.S. suppliers with 3D printing capability who design and manufacture new parts for these markets may be eligible for R&D tax credits.

![3D printed airbox lid for Honda TRX 450R [Source: Airwolf 3D ]](https://fabbaloo.com/wp-content/uploads/2020/05/tariff1_img_5eb08f80b140d.png) 3D printed airbox lid for Honda TRX 450R [Source: Airwolf 3D ]

3D printed airbox lid for Honda TRX 450R [Source: Airwolf 3D ]

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates for up to five years.

Conclusion

The ongoing U.S. / China trade war has caused a re-examination of many companies’ supply chains. This supply chain re-examination is occurring when the 3D printing industry has made great strides in the past years and can change the way manufacture supply chains work.