At AMS 2025, I heard what could be the most accurate prediction for the future of 3D printing.

The concept was proposed by Stratasys CEO Yoav Zeif, who reviewed the current state and future of additive manufacturing in his keynote address.

The current state of the industry is a bit shaky. We’ve seen multiple big players crash out of the market, and others shrink into much smaller niches. It’s a time of uncertainty, and Zeif’s concept seemed to cut right through the fog to show how all this is going to play out.

Zeif believes there is “something healthy” in this shakeout, where a transformation of the industry will take place.

He correctly pointed out that the change really began years ago, as most 3D printer manufacturers followed a rather simplistic strategy: build boxes (printers) with more and more features, and hope someone buys them. In fact, many 3D printer manufacturers still operate on this principle.

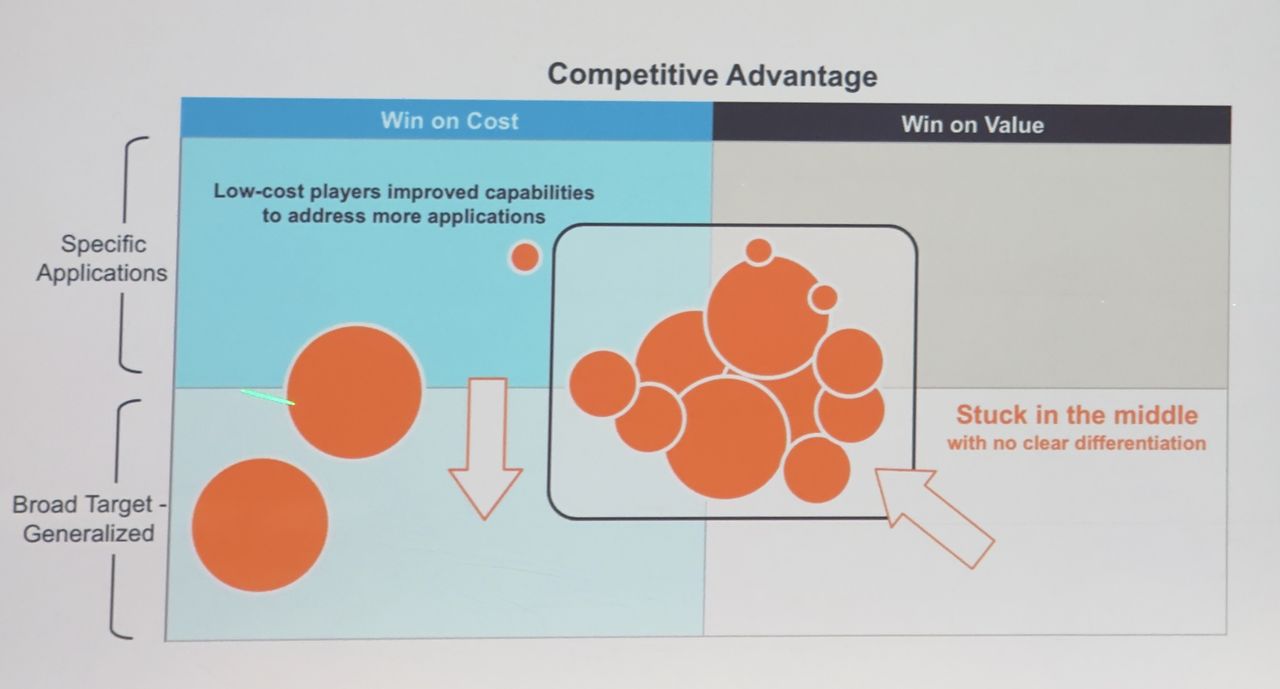

Zeif believes this business strategy has caused these companies to be “stuck in the middle”.

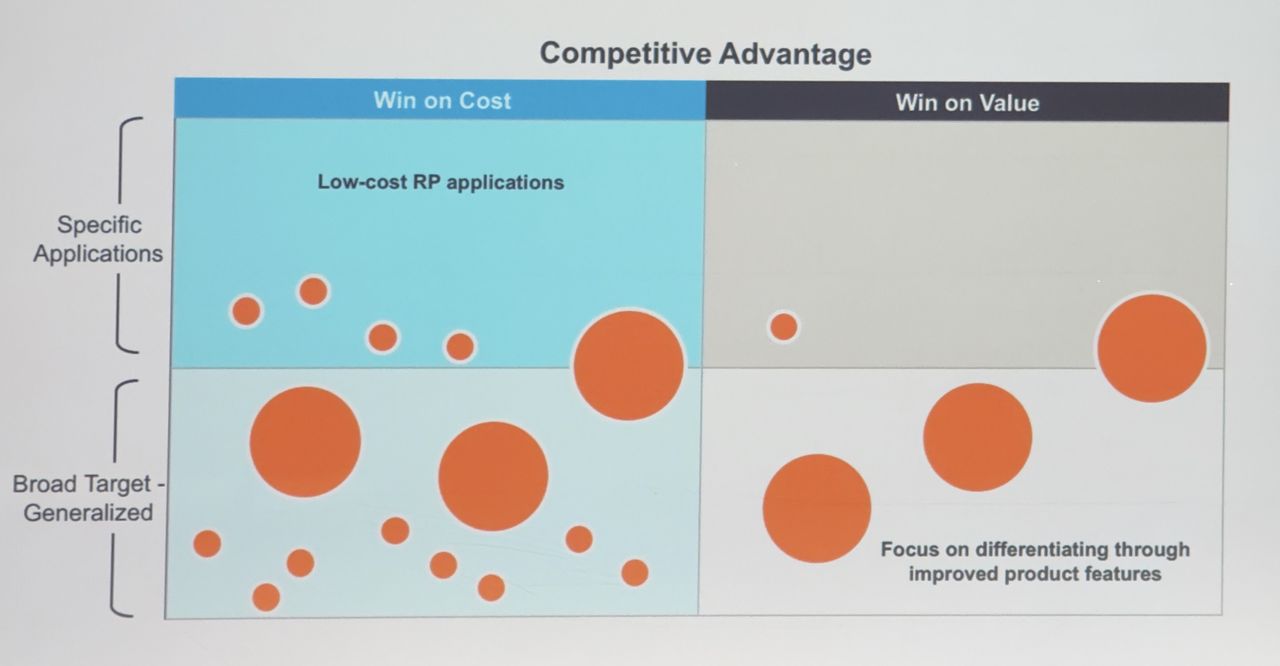

How’s that work? It all comes down to this chart:

Let’s walk through this. Basically, 3D printer manufacturers are classified on two axes:

- Whether they are focused on the lowest cost product, or producing the highest value (quality) product

- Whether their products are general purpose or designed for very specific 3D print applications

The unnamed bubbles indicate the places occupied by most of the bigger players in the 3D print industry. Notice there are few on the top half of the chart.

This is the problem: some of these cells are not viable. Zeif proposes there are only two viable cells, Broad+Cost and Specific+Value.

The other two cells just won’t work. For example, the Specific+Cost approach can’t work because you cannot achieve the lowest cost without massive numbers of shipments — which requires broad application capability.

Similarly, it’s not viable to have broad capabilities with value, because value requires customization for the specific applications.

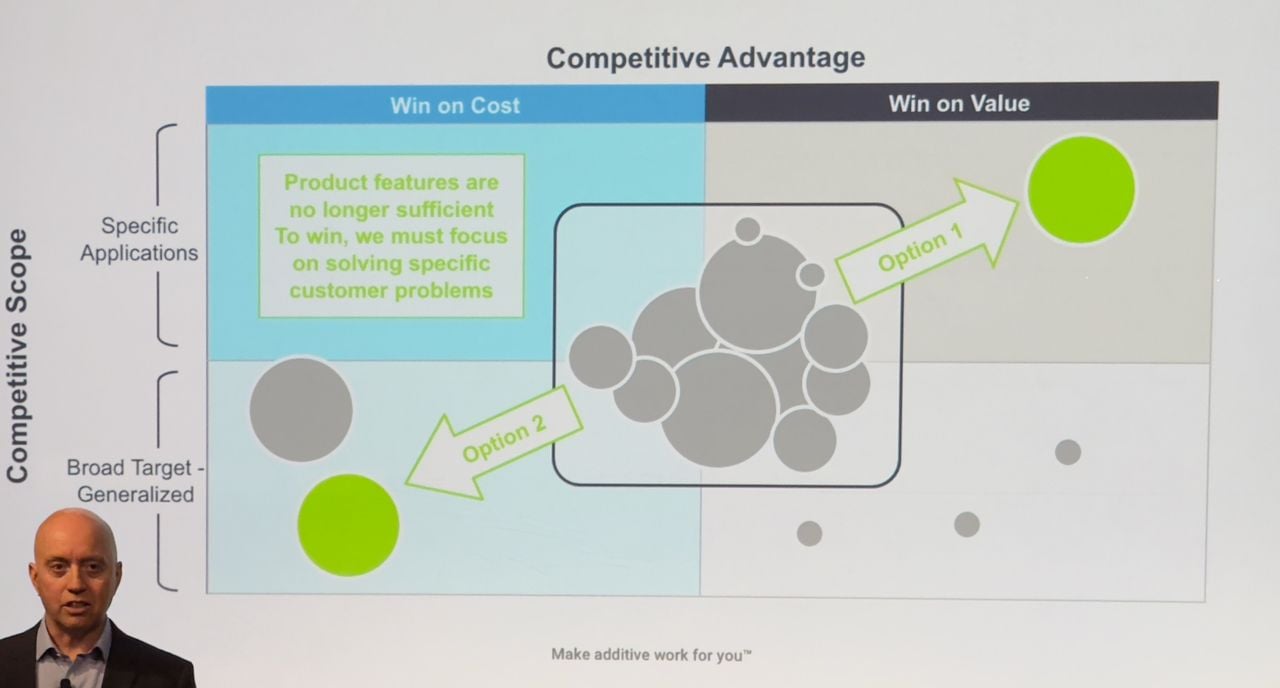

This, according to Zeif, means that companies stuck in the middle trying to do all of the above face a choice: they must move to Broad+Cost or Specific+Value. No other choices are viable.

This rings true and maps to the current situation. For example, successful companies like Bambu Lab produce vast numbers of products at very low cost — but don’t offer specialized solutions. Meanwhile, there are multiple smaller companies providing high value with specialized solutions using 3D printing. These companies are really selling the applications, and the 3D print technology is incidental. But it works, financially.

I think Zeif is onto something here, and his chart is something that 3D printer manufacturers should be examining closely. It’s quite likely we will see many 3D printer manufacturers shift towards one or the other strategies, with the remaining bunch in the middle eventually disappearing.

This is the new world of 3D printers.