Charles R. Goulding and Andressa Bonafe discuss how South American countries can leverage 3D printing technology to bolster their positions as emerging players in the global oil and gas market.

As major Western economies hope to reduce their energetic reliance on conflict-ridden Russia and the Middle East, South America emerges as a promising site for the next oil boom. A recent Wall Street Journal article underlines the potential of Argentina, Brazil, Guyana, Suriname, and Venezuela. 3D printing could play an important role in helping South American oil and gas companies establish themselves as global suppliers.

Argentina

With massive oil and gas reserves still intact, Argentina is often seen as the world’s sleeping energy giant. A growing number of companies are aiming to take advantage of the current geopolitical scenario by increasing their activities in Vaca Muerta, a vast oil and gas patch with huge output potential. In September 2023, Shell announced its plans to increase oil production by 5,000 barrels per day (bpd) at the Argentinean shale formation, reaching to 50,000 bpd. Pampa Energía, the largest independent energy company in Argentina, is also boosting investments in the area. With a primary focus on natural gas and electricity, Pampa announced a $200 million investment to develop a pilot shale oil project in Vaca Muerta, taking a bigger stake in the petroleum sector.

Shell already utilizes 3D printing, a technology that can certainly contribute to their success in expanding operations in Argentina. According to the British multinational, additive manufacturing has allowed for the production of spare parts on demand, the development of novel equipment, and the rapid prototype of engineering designs. Shell has been striving to develop capabilities that “bridge the gap between 3d printing manufacturers and the energy industry”, an effort that can greatly benefit companies working in South America.

In 2023, Shell went beyond the printing of dense parts, achieving a considerable technological breakthrough in the production of unique porous structures. Ed Ganja, Vice President for Catalyst and Analytical Technology at Shell underlines 3D printing’s key role in enabling the development of advanced catalytic materials with improved mass and/or heat transfers and better catalytic performance.

Brazil

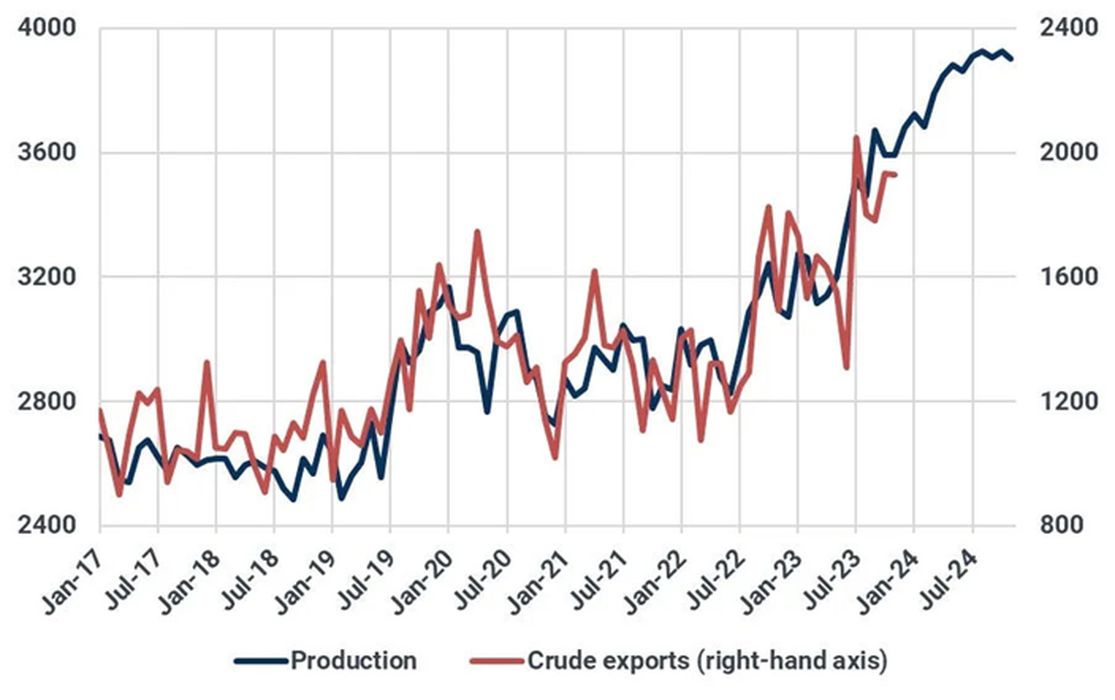

Brazil is also at the center of the South American oil boom, having reached record oil and gas output in September 2023 at over 3.6 million barrels a day. Petróleo Brasileiro SA (Petrobras), a state-owned multinational with over 37 thousand employees and a net income of BRL 188.3 billion in 2022, is largely responsible for the country’s performance.

[by Kpler / Source: Business Insider]

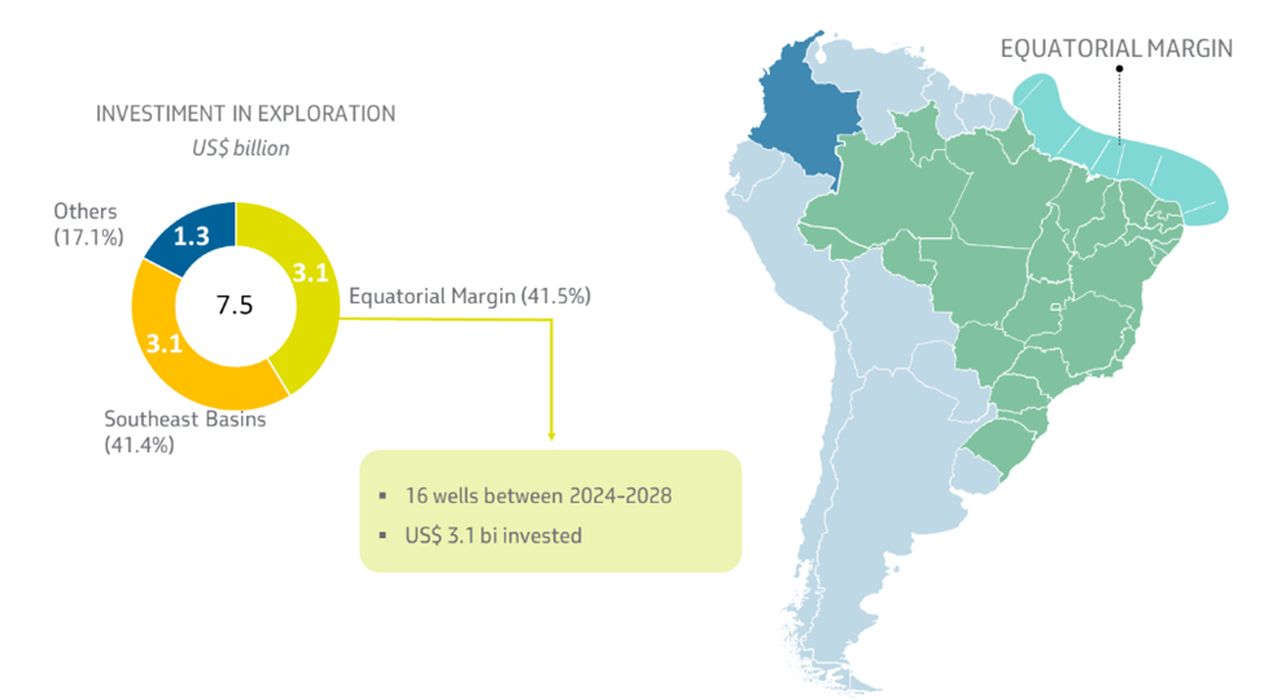

The Brazilian oil giant recently released a $102 billion, five-year investment plan that promises to boost oil exploration and production, areas that take up 72% of the predicted spending. Production is expected to rise from 2.8 million barrels of oil equivalent per day (boed) in 2024 to 3.2 million boed by 2028. Exploration plans include the Equatorial Margin, which covers nearly 1,370 miles of deepwater and ultra-deepwater reserves along Brazil’s northern and northeastern coast.

In 2021, we reported on Petrobras’s partnership with the German manufacturer of optical systems Carl Zeiss, and the Brazilian non-profit research and technology organization, SENAI, to advance the use of additive manufacturing for the production of critical oil and gas components. Research efforts focused on metal 3D printing methodologies, particularly Laser Beam Powder Bed Fusion (PBF-LB) as well as Laser Beam Directed Energy Deposition (DED-LB). It aimed to develop and validate approaches for the manufacturing and qualification of static and dynamic critical components for the oil and gas industry.

In December 2022, Petrobras opened its first dedicated lab focusing on additive manufacturing. LAB i3D supports 15 platforms producing replacement parts, parts that require improvements and customizations to meet specific demands, along with templates and tools to support operation and maintenance.

Guyana

Often referred to as one of the hottest energy frontiers, Guyana has experienced remarkable GDP growth in the last few years. ExxonMobil is the first and largest oil producer in the country, leading a consortium that is so far responsible for 46 discoveries since 2015, with more than 11 billion barrels of recoverable oil and gas.

As we reported in December 2022, ExxonMobil has been using 3D printing to create new acrylic, metal, ceramic spirals, and other shapes with advanced additive manufacturing capabilities. In that same year, the American multinational engaged AML3D to create what was then considered the world’s largest metal-printed commercial pressure vessel for use in refinery operations. The $190,000 deal targeted the production of an eight-tonne, high-pressure tubular vessel weighing over 2000 lbs. AML3D was to use its proprietary Wire Arc Manufacturing (WAM) technology, reducing lead time from 12 months to just 12 weeks.

More recently, ExxonMobil joined the Industry Collaboration Project (ICP), a global initiative led by software company Fieldnode to create an industry standard for a digital inventory ecosystem. The two-year project gathers energy leaders BP, ConocoPhillips, Equinor, Shell, TotalEnergies, and Vår Energi and aims to “develop a digital foundation to build a network for supply of spare parts produced on demand through additive manufacturing technology.”

The examples of Shell, Petrobras, and ExxonMobil shed light on the increasingly important role of 3D printing in the oil and gas sector. US-based companies engaged in similar efforts can take advantage of R&D tax credits, as described below.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Ongoing geopolitical turmoil in the Middle East and Russia has created an opportunity for South American countries to strengthen their role as international oil and gas suppliers. However, the region must face long-standing political risks and economic challenges that have curtailed its potential for global leadership. Energy companies working in South America can take advantage of 3D printing technology to enhance competitiveness and fuel the next oil boom.