A recent industry analysis report shows high revenue growth in 3D printing; so why are company valuations down?

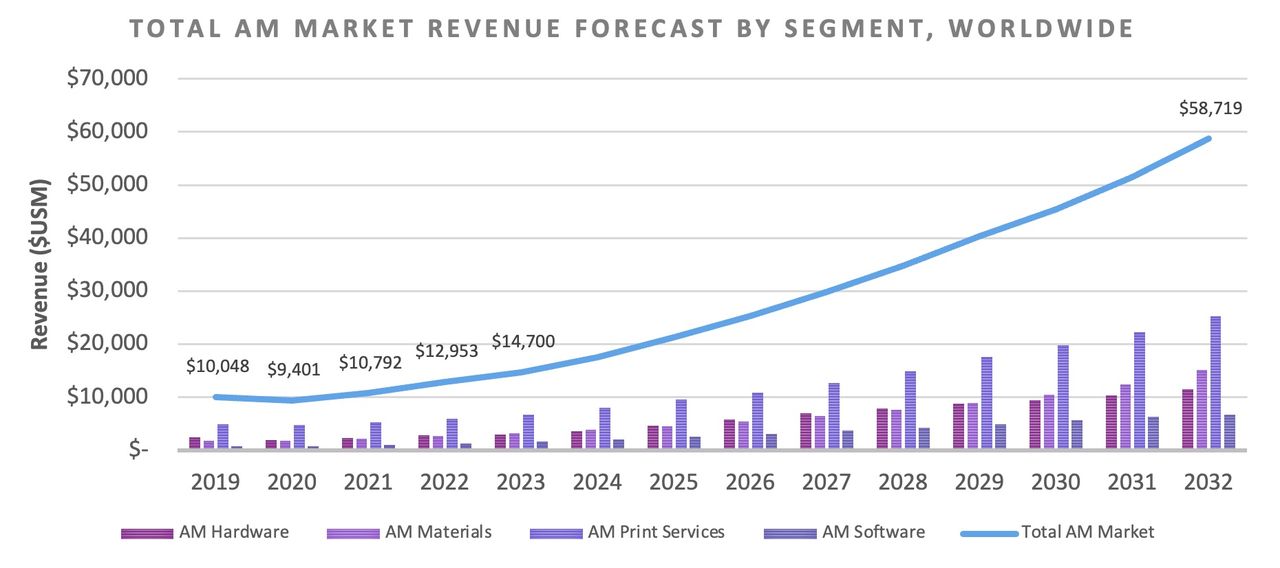

I’m reading a summary of a market report from Additive Manufacturing Research, which said the 2023 total revenue for the 3D printing industry hit US$14.7B. That’s a truly enormous number, far larger than I ever imagined years ago in the early days of the technology.

The report also said this amount represents an annual growth of 13%, quite a healthy bump. That would suggest customers are buying more 3D printing equipment, materials and services.

If there are more customers spending more money, then you’d expect the valuations of the companies providing these services to be similarly raised. After all, the valuation of a company is tightly related to how much cash it generates.

But that’s not the case. Fabbaloo tracks the valuation of publicly traded 3D print-related companies in our weekly report. The total value of our leaderboard in January 2023 was US$7.0B. At year’s end, the total was US$6.1B, a drop of about 13%.

That doesn’t jive with the market report.

So what’s going on here?

During 2023, our leaderboard had values as high as US$8.5B, but also as low as US$4.2B — half the peak within the same year. Today the leaderboard is hovering around US$4.8B.

How could an industry that grew 13% in revenue during 2023 suffer a loss of 13% in value — and even worse depending on the date of measurement?

There are a couple of answers here.

First, remember that our leaderboard tracks only publicly traded companies. There are plenty of privately held companies, such as EOS, ICON or others that provide no public visibility of their revenues. It may be that the publicly traded companies are suffering, relative to private companies that might be increasing their revenues at a higher rate.

The other answer has to do with the statement above, “the valuation of a company is tightly related to how much cash it generates.”

That is not precisely true. A more accurate statement would read: “the valuation of a company is tightly related to how much cash it COULD generate IN THE FUTURE”.

In other words, speculators value a company not on the revenue it provides today, but instead on what it might be later when they consider selling their shares. Buy low, sell high, they say.

If we then look at the enormous volatility of the leaderboard total throughout 2023 we see huge swings upward and downward. Those swings might be considered a proxy for investor sentiment. If investors feel 3D print companies might generate more cash in the future, then prices rise. If not, they drop.

What we were seeing in 2023 was clearly dramatic swings in sentiment, with investors ultimately turning towards the negative: they currently don’t have faith that 3D printing will grow nearly as much as they had previously believed.

My thinking is that they are wrong. The technology is indeed growing, as testified by the market report. What’s at issue here is how long that growth will take.