I’m reading a financial forecast for 3D printing and it doesn’t seem to match the current state of the industry.

The report, from Additive Manufacturing Research, is from their annual AM Parts Produced report. Among other data, the report provides an estimate of the total value of polymer and metal 3D printed parts made currently annually and a forecast into future years. It’s based on “real market activity” up to mid-2023, and their own projections for the future.

There were several highlights from the report provided, including:

- Metal prototyping slowed, but end use metal part production increased

- Polymer prototyping increased slightly, and end use parts increased

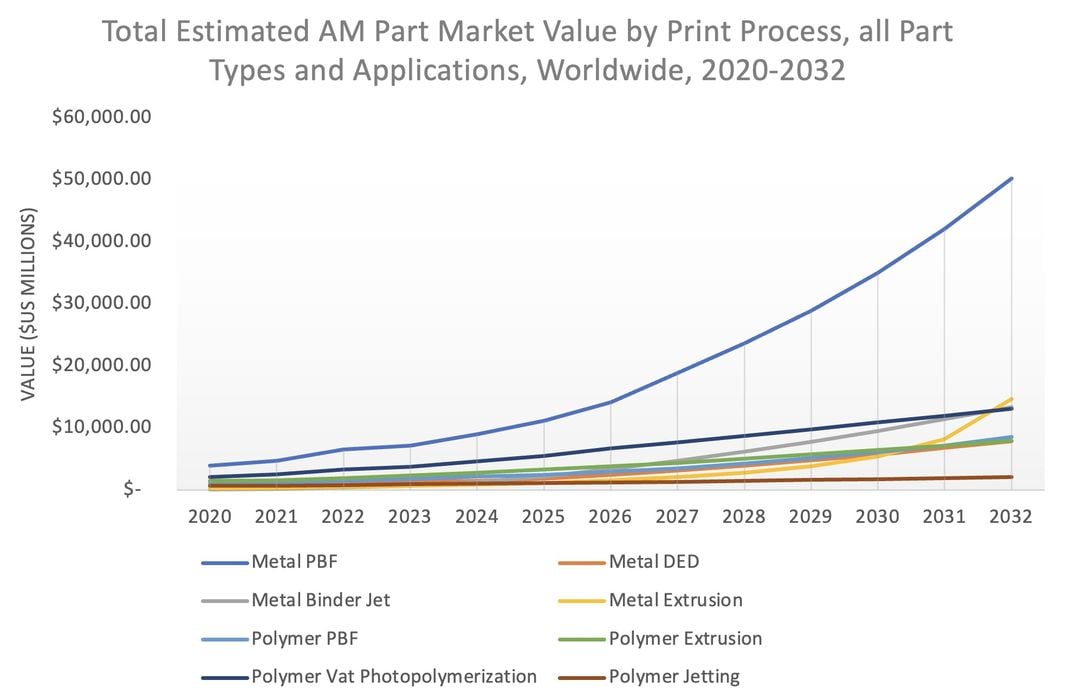

- They project polymer powder bed fusion (e.g. SLS) will double that of extrusion (e.g. FFF)

- Mixed results in the dental sector, a major usage area for the technology

What caught my eye, however was this statement:

”3D printed parts expected to reach $18.8B in value in 2023, grow to $119B in 2032.”

That is a rather large rise in usage, and in only nine years.

This seems contrary to recent discussions about the 3D print industry. Those discussion basically read like this:

- An enormous amount of capital investment has been placed into the 3D print industry

- The companies invested into have not grown proportionate to the investments

- Revenues are flat

- The total value of the industry is far less than the investments placed

This all sounds bad, and it seems that the technology is gaining a bad reputation among investors because of this.

Some have proposed that the industry took the cash but didn’t deliver because they were not innovative and became used to big handouts. The buzz even suggested that the industry is dying. I published a rebuttal where I proposed that yes, some companies indeed are in that state, but that there are plenty of companies that are not, and have been operating quite successfully, largely without dependence on major VC investments.

We do find ourselves in a state where there are multiple big 3D print companies that basically don’t have the value their investments intended. This is inevitably going to lead to failures and consolidations of some sort, but we cannot know how that will play out.

Back to the research prediction: in a world of today where the “industry is dying”, “revenues are flat”, and “consolidation is coming”, how can it be that revenues will be 6.2X bigger in nine years? That’s something like a 25% boost for each of those nine years.

The research is very likely based on projected demand. In other words, companies will want an increasing amount of 3D printed parts each year going forward. Someone will have to provide those parts.

The question is, if this demand is real, then why are the valuations of current companies so low? Won’t they be the companies that will serve that 6.2X demand in 2032?

It may be that the nature of the technology is at fault. The current technologies used by the companies might perhaps be too expensive to scale, and that newer approaches are required to actually address the increasing demand.

I believe the demand for 3D printed parts in 2032 will be vastly greater than today. But I also believe that the leading companies of today can’t really address that need without new tech. That’s why I am always looking at new 3D print technologies with a view for efficiency, cost and scalability.

There are countless new 3D print technologies revealed each year, and there just might be a few new players that do indeed have the scalability that might address the 2032 needs.

For the existing leaders, it may be useful for them to quickly find those new players and acquire them.