Charles R. Goulding & Ryan Donley look at the supply chain challenges of Polaris, and how 3D printing could help.

Polaris Industries is one of the leading sports vehicle makers in North America. The company dominates with a 51% market share (up from 40% in 2020-21) in the segment and has steadily increased revenue through the years.

Amidst the great performance by Polaris though, a delicate supply chain has forced the company to shift strategies and produce their products based on whatever parts they have on hand. The parts situation has further escalated amidst a trade conflict between the United States and China that imposes heavy tariffs on Chinese imported parts.

Polaris is lobbying for tariff exemption among numerous Chinese imported parts. However, there are 150 ATV retailers campaigning for tariff exclusions on fully finished Chinese ATVs, pitting Polaris against the rest of the ATV market. Polaris manufactures all its vehicles in the United States from an array of imported parts, local suppliers, and internally manufactured parts whereas the rest of the market segment imports full finished products that go straight to retail.

The impact of tariffs on Chinese imported parts and the dozens of supply chain bottlenecks Polaris faces compounds daily as production cycles and strategies are now based on innovating with whatever parts are readily available. Polaris’ production management is discussing daily how to tackle these issues head-on and buy some time. The company has even placed responsibility on the retailers to take in mostly finished motorsport vehicles and have them on hand until the necessary parts arrive to finish them.

With the pressure of external parts issues Polaris faces, Polaris could shift to producing standard parts in-house and alleviate the complex supply chain problems. Polaris has a significant investment in 3D printing technology from the printers themselves to new material. The partnership between Stratasys and Polaris has made a significant impact on iterating upon numerous innovative designs as well as material analysis for complex part experimentation.

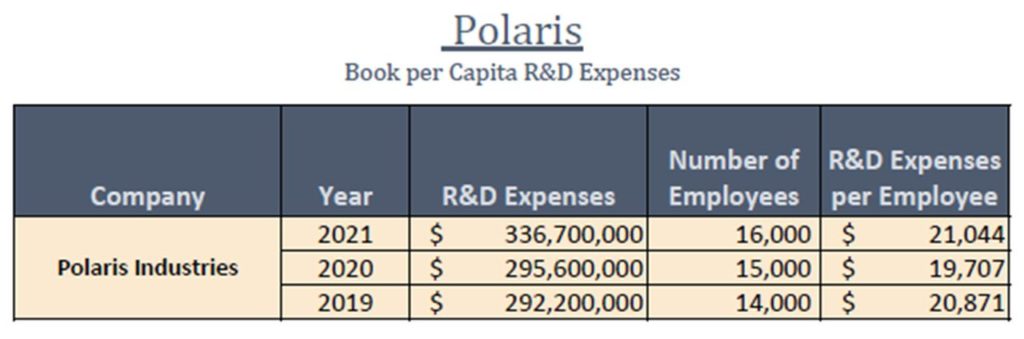

As shown in the table above, Polaris is committed to research and development (R&D) and has numerous dedicated buildings for R&D with a total staff of 1,400 employees, including additive technology designers and engineers. The company plans to leverage more facilities for the research and development of prototype parts and systems.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software. Eligible costs include U.S.-based employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, contract research expenses, and certain costs associated with developing a patent. As of 2016, eligible startup businesses can use the R&D Tax Credit against $250,000 per year in payroll taxes.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Utilizing additive manufacturing in-house to source more parts can be a significant investment of resources. Polaris currently has the capital investment in additive manufacturing to begin using the technology and rely less on importing parts and external suppliers and combat their competitors in the industry.