Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s first take a look at the major 3D printing companies on this week’s list. I consider these companies “major” because their market valuations are significantly larger than others in the space.

Major Players

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 3354 | +85 |

| 2 | Xometry | 2458 | -37 |

| 3 | Protolabs | 1984 | +18 |

| 4 | Desktop Metal | 1942 | +138 |

| 5 | Stratasys | 1833 | +86 |

| 6 | VELO3D | 1504 | +82 |

| 7 | Nano Dimension | 1384 | -10 |

| 8 | Materialise | 1290 | +77 |

| 9 | Markforged | 1199 | -59 |

| 10 | Shapeways | 564 | +58 |

| 11 | ExOne | 494 | +7 |

| 12 | SLM Solutions | 450 | -10 |

| TOTAL | 18455 | +292 |

This week saw very little movement among 3D printing companies in general.

However, there were two exceptions.

Desktop Metal, currently in position four on our leaderboard gained almost eight percent over the week. It’s totally unclear why this shift occurred, as there was no specific news that might have driven this investor interest, aside from a relatively minor announcement regarding the qualification of a new nickel alloy for their Production System.

The big winner of the week was newcomer was Shapeways. (Am I still allowed to call them a newcomer after four weeks on the leaderboard?) Nevertheless, the 3D print service’s valuation rose over eleven percent from last week.

Here there was indeed some news that could drive their valuation higher. The company announced a powerful software system called “Otto”, which should make it far easier for small and mid-sized manufacturers to make frequent use of Shapeways’ services. At the time of the announcement, I felt that this would certainly drive a considerable amount of new business towards the company.

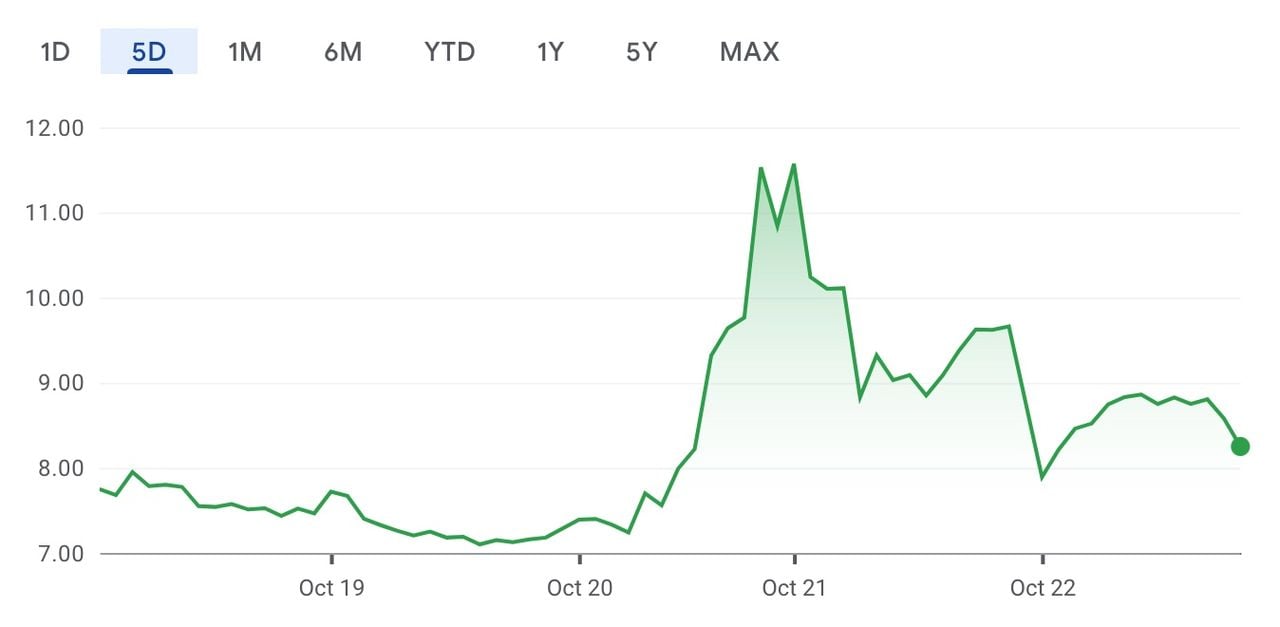

If we look at Shapeways’ stock price over the week we can clearly see when the announcement was made, on October 20th.

Note that their stock price actually skyrocketed immediately after the announcement, before settling down at week’s end to US$8.23. However, at one point it was actually up to US$12 per share. At that price, their valuation would be approximately US$700M, not quite enough to leap over the next position on the leaderboard, Materialise.

One more thing: Materialise leapt over Markforged by a slim amount to take eighth place, as they happened to gain slightly this week, while Markforged happened to drop a small amount.

Other Players

| RANK | COMPANY | CAP | CHG |

| 13 | MeaTech 3D | 84 | +2 |

| 14 | voxeljet | 63 | 0 |

| 15 | ARC Group WW | 22 | 0 |

| 16 | AML3D | 15 | -2 |

| 17 | Aurora Labs | 14 | 0 |

| 18 | Tinkerine | 2 | 0 |

| TBD | Massivit | TBD | TBD |

| TOTAL | 200 | -1 |

The lesser valued companies tend to have much smaller shifts in their market capitalization because there is far less trading occurring on their stocks. The big money tends to hover around the larger players.

This week saw essentially zero movement among the smaller players. This week is certainly the dullest yet since we began tracking these valuations. Only two shifts occurred: MeaTech 3D rose two percent in value, likely due to bounce back from price volatility after their unusual Ashton Kutcher announcement some weeks ago.

AML3D dropped about ten percent, which isn’t an unusual amount for smaller companies. Even this shift didn’t alter their position on the leaderboard: 16th. In fact, the entire smaller players list in total moved less than one percent.

Note that we are unable to obtain Massivit’s market cap value, as it does not seem to be published, even though they are a publicly traded company on the Tel Aviv Stock Exchange.

Upcoming Changes

We are still awaiting the appearance on the market of two other 3D print companies. One is FATHOM, a digital manufacturer, which has been developing a SPAC (Special Purpose Acquisition Company) maneuver to complete later this year. The other is Fast Radius, a digital manufacturing cloud service.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t now exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.