Which 3D print company is the biggest? [Image by Stefan Keller from Pixabay]

Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s first take a look at the major 3D printing companies on this week’s list. I consider these companies “major” because their market valuations are significantly larger than others in the space.

Major Players

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 3775 | +316 |

| 2 | Xometry | 3078 | -234 |

| 3 | Desktop Metal | 2289 | -113 |

| 4 | Protolabs | 2193 | -41 |

| 5 | Markforged | 1747 | -152 |

| 6 | Nano Dimension | 1438 | -114 |

| 7 | Stratasys | 1402 | +48 |

| 8 | Materialise | 1229 | -41 |

| 9 | ExOne | 539 | +162 |

| 10 | SLM Solutions | 469 | +11 |

| TOTAL | 18158 | -158 |

This week saw tremendous ups and downs and some notable changes.

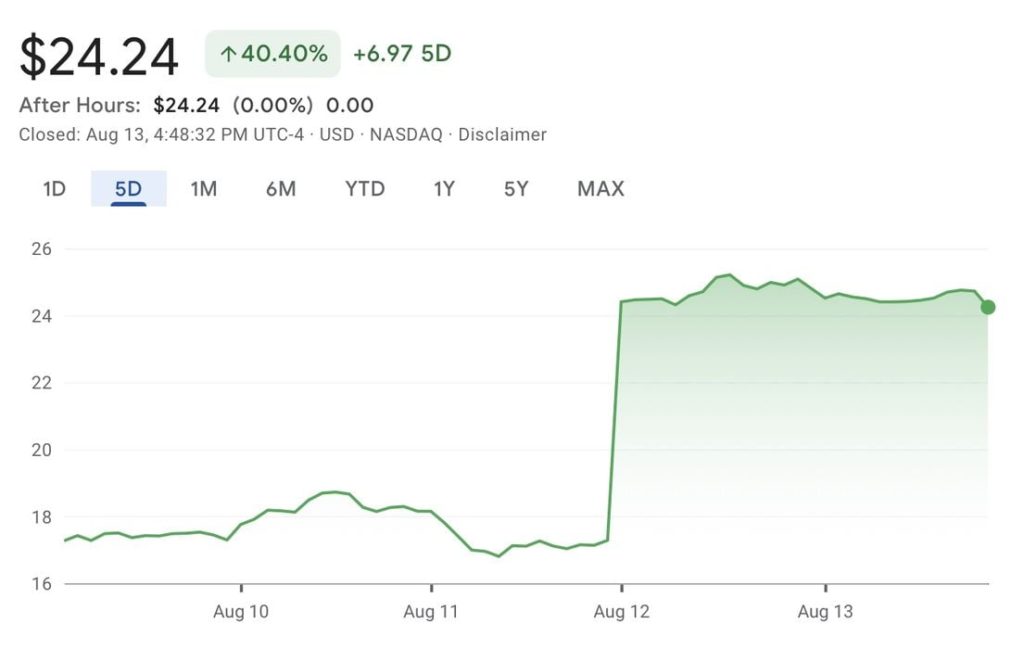

Let’s start at the top, with 3D Systems undergoing a remarkable journey through the week. There was a very significant rise in stock value, before it settled down near where it started. This chart shows the highly dramatic jump, where trading volume leapt near 20X typical values.

At one point during the week, 3D Systems stock topped US$40, implying a market cap of over US$4.5B, by far the largest value in history for a single dedicated 3D print company. The company at that point had gained over US$1B over the previous week’s valuation, an incredible feat.

What was behind this massive jump? It has to do with the company’s recent financial results, in which they turned a profit. I reported this last week, but it seems it took a few days for the market at large to notice. There’s also hints that some of the massive jump was due to social media effects.

However, by week’s end 3D Systems had settled at a level slightly higher than last week, keeping the company in the first position on our leaderboard.

The other major happening this week was a consolidation: Desktop Metal acquired ExOne, both listed on our leaderboard.

The terms of the deal involve providing ExOne shareholders with more-or-less the same value of Desktop Metal stock, plus an amount of cash. Very coincidentally, the market cap of ExOne seems to have risen by about that same amount of cash. If that doesn’t make sense, I don’t know what does.

The boost to value in ExOne allowed them to leapfrog SLM Solutions and land in position nine.

You might be wondering why ExOne still appears on the leaderboard. That’s because while the deal was announced, it hasn’t yet closed. Therefore, ExOne operates as a separate company for the time being, and at some point they will disappear and their value will flow into Desktop Metal.

And what of Desktop Metal this week?

They dropped almost five percent in market capitalization, so it’s not clear what investors think of the deal. We may see some movement in coming weeks as Desktop Metal’s intentions become clearer.

Other Players

| RANK | COMPANY | CAP | CHG |

| 11 | MeaTech 3D | 81 | 0 |

| 12 | voxeljet | 60 | -5 |

| 13 | ARC Group WW | 29 | 0 |

| 14 | AML3D | 21 | 0 |

| 15 | Aurora Labs | 13 | +2 |

| 16 | Tinkerine | 3 | 0 |

| TBD | Massivit | TBD | TBD |

| TOTAL | 206 |

The lesser valued companies tend to have much smaller shifts in their market capitalization because there is far less trading occurring on their stocks. The big money tends to hover around the larger players.

This week saw little change on this list, with the sole exception of Aurora Labs, which jumped almost 21 percent in value. It’s not clear the reason for this jump, but I suspect it may relate to the company’s announcement of meeting yet another milestone on their journey to 3D print one tonne of metal in 24 hours.

This milestone adds confidence to their strategy and thus could have caused this week’s stock price jump.

Note that we are unable to obtain Massivit’s market cap value, as it does not seem to be published, even though they are a publicly traded company on the Tel Aviv Stock Exchange.

Upcoming Changes

We’re still awaiting the debut of VELO3D and Shapeways on the markets, having previously been announced.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t now exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.