Stratasys continues in targeted 3D printing M&A, today announcing that it is acquiring UK-based RPS.

RPS 3D Printing

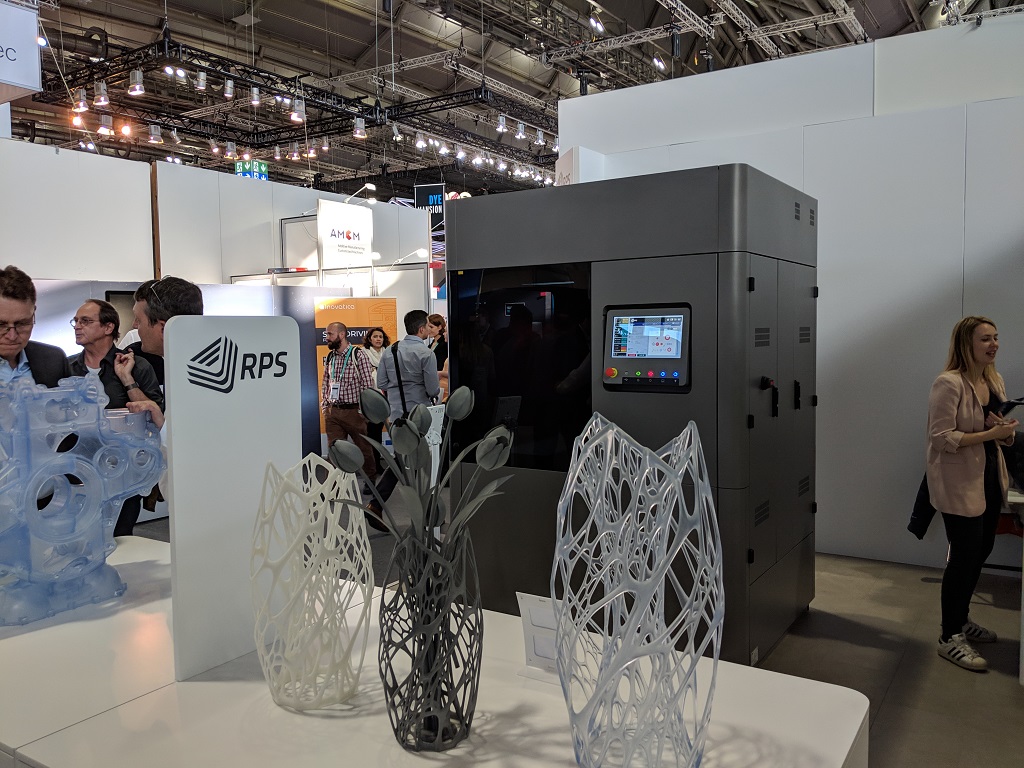

RPS — officially RP Support Ltd — has developed an impressive SLA-based portfolio. The company’s origin story is based on expertise in both engineering and stereolithography.

“We have a good group with a lot of experience with SLA,” Production and Development Manager Simon Tyler said of the team when we spoke at Formnext 2018. “I’ve spent my entire working life, since 2001, with SLA. You have to listen to people and what they want. It creates a stronger bond, and repeat customers.”

Initially working with 3D Systems’ SLA equipment, the RPS team modified the 3D printers enough that they determined the best way to get their customers what they needed was to fully build their own equipment. The resulting 3D printing systems are impressive in their clean simplicity. And those results have been noticeable.

The Neo 800, for example, offers high-quality results. In October, RPS introduced the Neo 450 industrial line of 3D printers. The company has also enabled work with experimental materials outside its primarily DSM Somos options. Their materials development kit (MDK) has proven a point of interest for getting exactly the results and materials quality needed. On top of 3D printers and materials focus, the RPS team also developed their own Titanium software powering their systems.

All in all, RPS is an intriguing, promising company with proven technologies. And that’s been noticed.

Stratasys Acquisition

Stratasys has unabashedly been focusing on its “polymer suite of solutions across the product life cycle, from concept modeling to manufacturing” and what that means for its leadership position in the 3D printing industry. Hot on the heels of its acquisition of P3 DLP 3D printing company Origin, which closed at year-end 2020, today Stratasys has announced that it is acquiring RPS.

The release says:

“RPS’ complementary technology further expands Stratasys’ polymer suite of solutions across the product life cycle, from concept modeling to manufacturing. Stratasys will leverage its industry-leading go-to-market infrastructure to offer RPS’ Neo line of systems to the global market with an expanded set of applications. Stratasys expects the acquisition to be slightly accretive to revenue and non-GAAP per-share earnings by the end of 2021.”

Other than that brief note about revenue expectations, no financial information is included in the press release.

Stratasys Strategy

This latest acquisition brings more SLA into the Stratasys portfolio. RPS’ long experience with the technology brings immediate access to expertise as well as fully functional operations.

Stratasys had announced its own SLA system, the V650 Flex, in 2019, following years of in-house work with it… but I know I haven’t heard much about this particular 3D printer in a while. Like the Neo line, the V650 Flex offers a large-format open materials SLA system and a partnership with DSM for Somos resins. So there’s also a very direct fit in Stratasys’ experiences and a clear place for RPS’ additions to the portfolio.

Further fitting RPS into the Stratasys portfolio is the software side; the press release explains:

“In addition, all Neo systems are Industry 4.0-ready, with Titanium control software that includes a camera, network connectivity, support remote diagnostics, and mid-build parameter customization. The printers can automatically email progress reports on jobs. Stratasys plans to integrate its GrabCAD Print workflow software into future versions of the product.”

For RPS’ part, the jump over to becoming a Stratasys company brings many of the oft-touted benefits of such a move. Access to a global sales and marketing network, access to more expertise and resources, and the relative comfort of being with a long-established purely 3D printing-focused major player are no small things.

“We developed the Neo line to raise the industry standard for the next generation of large-frame industrial stereolithography 3D printers,” said RPS Director David Storey. “I’m looking forward to continuing to develop this best-in-class technology with the Stratasys team as we bring our products to a broadened global audience.”

And Stratasys? Their M&A activity may have only just begun (again) as the Origin and RPS moves offer us a look at where they’re investing.

“As businesses accelerate their adoption of additive manufacturing, our goal is providing our global customers with the world’s best and most complete polymer 3D printing portfolio,” said Stratasys CEO Yoav Zeif. “We believe the Neo products are superior relative to other solutions currently available in the market due to an open choice in resins, low service requirements, and reliable and accurate builds with simple day-to-day operation. With access to our strong global channels and our innovative GrabCAD software, we will bring RPS’ innovative products to many more manufacturing organizations.”

Is 2021 truly to be the year of consolidation in the 3D printing industry? With so many moves recently, with a production focus, it could just be.