Charles R. Goulding sets sail with the idea of 3D printing for technologically advanced boat manufacture.

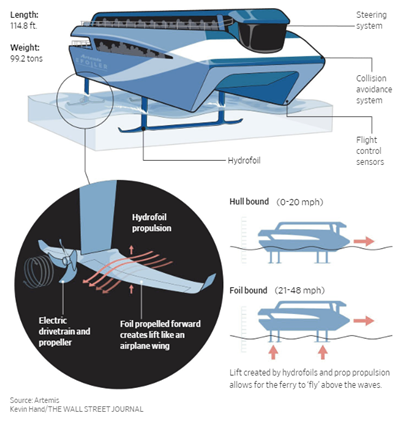

In June of 2020, Artemis Technologies raised $44 million to build a technology-enhanced Hydrofoil ferry in Belfast, Ireland. The technology concept behind Artemis Technologies’ evolved from Artemis Racing, which built one of the world’s fastest boats in the 2017 America’s Cup Sailing Competition. Just like Formula One for auto racing, the America’s Cup encourages technological advancements in boating.

The ultimate goal for Artemis Technologies is to build a wind-electric hybrid ferry capable of transferring passengers at 60 miles per hour. Concurrently, they want to use advanced technology to increase fuel efficiency and reduce emissions. Their timing may be excellent with many people now desiring to avoid mass transit.

Artemis Technologies needs to develop newer, stronger, lighter components. These are perfect specifications and applications for 3D printers.

We have recently authored an article for Fabbaloo describing the use of 3D printing for conventional boat building, including propellers. The New York Yacht Club American Magic Racing Team is working with Stratasys on their future hydrofoil entry to enhance performance with one focus being meeting weight limits.

Developers of advanced boat technology can use Federal and State R&D tax credits to support technological advancement.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Smooth Sailing

It is good to see Stratasys working with the U.S. American Magic Team hydrofoil. One of the most important long-term benefits may be high-speed, low emission ferries that the entire world can benefit from.