Charles R. Goulding revs up the idea of 3D printing in the Harley-Davidson supply chain.

In May of 2020 Harley-Davidson, while reopening its U.S. motorcycle plants, sent its dealers a memo that 70 percent of them would only be receiving two new bikes for the rest of the year. Obviously, its almost 700 dealers who have been closed during the COVID-19 crisis will find it difficult to function with this limited inventory. Some dealers are turning to refurbishing used bikes to sustain the pipeline.

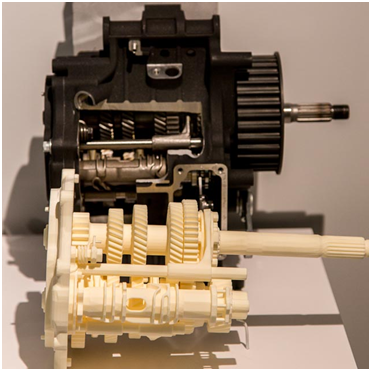

Harley-Davidson has a new CEO who wants to simplify the business and reduce the number of model offerings. Having a reduced number of models should enable Harley-Davidson to further digitize the business including more components to be 3D printed.

Harley-Davidson ‘s new CEO is Jochen Zeitz, the former CEO of Puma, the footwear and apparel company that has deep 3D printing expertise. The dealers can use 3D printing to replace needed parts on the wide variety of used bikes available on the market.

3D printing replacement parts for Harley-Davidson bikes can also qualify for economic benefits such as the R&D tax credit.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

Conclusion

Reducing product availability just when post-coronavirus customer demand is surging is a risky path to take. It will be interesting to see how this rides out.