Charles R. Goulding and Preeti Sulibhavi examine how 5G networks can benefit from 3D printed MIMO antennas.

All eyes are on Ericsson, the Swedish company that is emerging as the sure but steady leader in the $80 billion per annum cellular equipment industry, as it moves forward to roll out 5G technology worldwide. Due to global concerns regarding China’s history with cyber-spying on US assets and privacy/security concerns, there are global lobbying efforts to ban Huawei Technologies Co. All of this has thrust Ericsson into the limelight.

5G Technology refers to the 5th generation mobile network and the new global wireless standard. It allows for everything from virtual connectivity to multi-Gbps peak data speeds and ultra-low latency with increased reliability and network capacity.

5G networks can benefit from 3D printing.

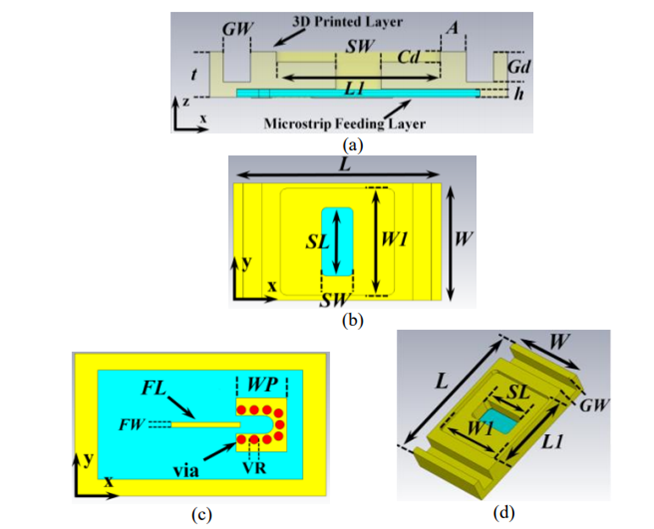

The advantage lies in producing Multiple-In Multiple-Out (MIMO) antennas for the 5G network. MIMO is an antenna technology for wireless communications with which multiple antennas are used at both the source (transmitter) and the destination (receiver). The antennas at each end of the communications circuit are combined to minimize errors and optimize data speed. The expectation is that 5G wireless technology will expand exponentially in the next few years.

3D printing can be a leading player in this industry. Additive manufacturing can produce high-performance antennas that are steerable and effective, minus the exorbitant costs associated with traditional manufacturing. It’s a win-win.

R&D tax credit incentives are available to new and improved mobile technology, particularly technology that involves 3D printing.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

Conclusion

To improve the 5G network, expected to grow enormously in 2020 and beyond, 3D printing should be there. This is a great time for 3D printing to get on the same wavelength as 5G.