Cameron Torti & Charles Goulding investigate several major truck manufacturers’ use of 3D printing technologies.

Volvo Trucks

3D printing has made massive strides in the last decade and some firms in the transportation industry, such as Volvo, have fully embraced it. Aside from improvements in 3D printing that slash prototyping costs and expedite logistics, external forces have made additive manufacturing more alluring for the transportation industry as a whole. Adoption of AM practices is a direct result of improvements in automation, artificial intelligence, the constant need for cost-cutting, driver shortages, and a shift toward electric and self-driving freights.

Volvo has drastically enhanced its manufacturing process by using 3D printers to produce the tools and fixtures needed to make their parts faster and with an ever-increasing degree of quality. The technology was utilized to develop a one-piece diffuser used in the paint atomizer cleaning process, resulting in savings of more than $1000 per part.

Volvo states that quality and precision have been upgraded, errors eliminated, and First Time Yield rose significantly. All things printed, whether they be tools or parts, were made at their Dublin, Virginia plant. Being able to construct these items in-house removes related shipping costs and complications, thus improving the overall efficiency of the plant and reducing inventory expenses.

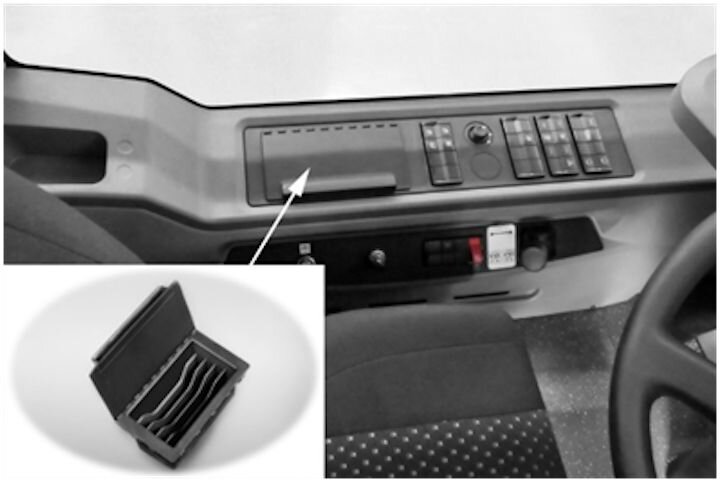

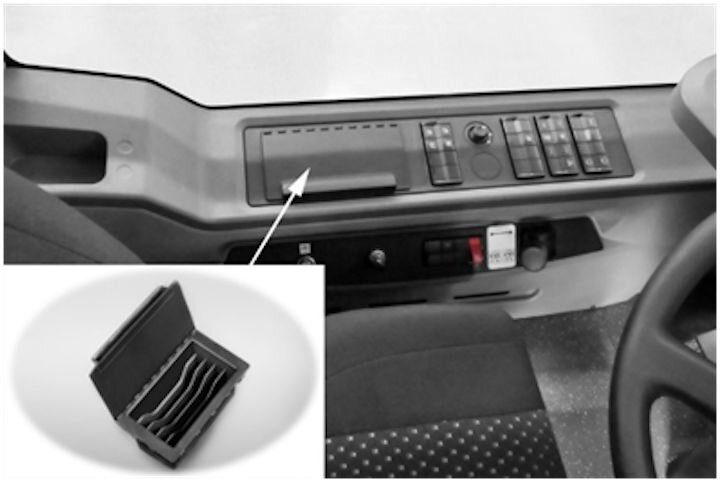

Manufacturing and assembly tools are being made in 94 percent less time using a Fortus 3D production system and multi-piece parts are consolidated into single items.

Additionally, old tools and parts don’t need to be kept around for years, wasting floor space. If needed, they can print replacement parts in a few hours or minutes. Currently, over 500 manufacturing tools and fixtures used to create Volvo trucks are AM made which signifies that this technology has now become a staple for the world’s second-largest truck manufacturer.

Daimler/Freightliner

Daimler, the largest truck manufacturer, has partnered with EOS and AEROTEC to fully automate their production line in an industry 4.0 pilot plant. After two years of honing their process, the company expects to reduce the cost of manufacturing parts by nearly 50% in 2019. The next generation production line is controlled from a central control station, requires no manual labor, and status information can be retrieved on mobile devices.

Jasmin Eichler, Head of Future Technologies at Daimler AG, says that 3D printed products can “be produced more cost-effectively, and faster” and this holds for gas and electric vehicles alike. The automation of the entire production line improves scalability and the 3D printed parts help reduce weight which is especially critical in electric vehicles.

Navistar

Josef Kory, Navistar’s senior VP of parts said earlier in 2019 that the Navistar has been experimenting with 3D printing as well. He anticipates that this technology will be especially useful for “low volume, end-of-life parts where tooling doesn’t exist” when it isn’t worth reinvesting in older tooling.

There is always a need for older truck parts and 3D printing extends the lifecycle for these vehicles. The company has also been looking to streamline its dealership experience. Typically, it takes trucks 24 hours to be serviced and part deliveries are the main reason why it takes that long. With on-demand 3D printing, they hope to reduce the service time to just 6 hours.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates for up to five years.

Conclusion

As more and more manufacturers assimilate 3D printing into their operations, the process improvements will be reflected through the trucks outputted. Being able to prototype rapidly using AM will enable truck makers to lower the weight of their units, develop better engine technology, and shorten production times.

It has also been invaluable for developing electric vehicles. Whether it is a reduction in plant-related costs, or savings resulting from more efficient vehicles, manufacturers have a lot to gain from employing industry 4.0 methodologies.