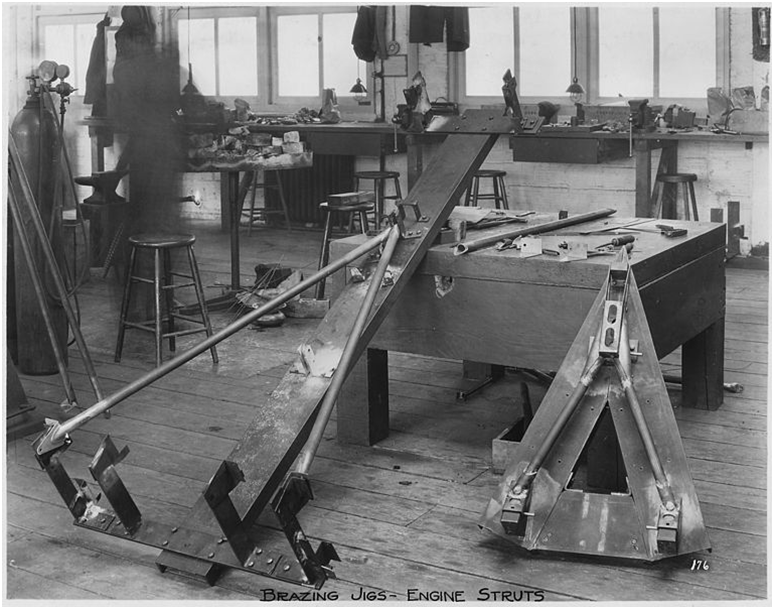

![[Source: Wikimedia ]](https://fabbaloo.com/wp-content/uploads/2020/05/Brazing-Jig_img_5eb08e77ee033.png) [Source: Wikimedia ]

[Source: Wikimedia ]

Charles Goulding and Dylan Comerford of R&D Tax Savers discuss 3D printing in creating all-important manufacturing aids.

When recently asked on a 1 to 10 scale about how 3D printing is currently best used in manufacturing, Ford Motor Company’s Chief Technology Officer Ken Washington rated manufacturing aids at 7, the highest scale category.

Manufacturing aids include jigs, fixtures, patterns, tools, devices, and platforms. These are the items that are used to create, enhance and facilitate manufacturing production and assembly.

Ken Washington provided this manufacturing aids response on a 2019 U.S. Manufacturing Day panel that included Ric Fulop, Founder and CEO of Desktop Metal, John Hart, Professor of Mechanical Engineering at MIT, as well as Terry Wohlers, President of Wohlers Associates, who moderated the roundtable discussion.

Understanding the real-world uses of additive manufacturing is important as these technologies continue to see rising adoption.

The roundtable discussion included conversation around applications, technologies, and trends. The well-regarded panelists are all well placed to speak to manufacturing use, appropriately for the observation of Manufacturing Day.

The full 45-minute panel is well worth a watch to hear from some of the foremost minds in additive manufacturing and industry today:

Participants in the additive manufacturing industry may be eligible to receive R&D tax credits.

The Research & Development Tax Credit

For R&D tax credit purposes, it is important to recognize that in the United States designing and creating manufacturing aids are considered process improvements eligible for the Federal and state tax credit.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, were of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Conclusion

When doing their credit calculations, many manufacturers only focus on new and improved products and omit the process side which can sometimes double the amount of potential R&D tax credits.