![Chart from the Market Guide to 3D Printers, 2019 [Source: Gartner]](https://fabbaloo.com/wp-content/uploads/2020/05/gartner2019-3dp-counts-ov_result_img_5eb09b23bce82.jpg)

A report from Gartner suggests there are a record number of 3D printer manufacturers.

Gartner is one of the leading industry analyst companies, with experts covering almost all commercial technologies in use by industry. Of course, they cover 3D printing as well, with Fabbaloo friend Pete Basiliere providing the analysis.

Basiliere’s latest post describes some details from their recent extensive survey of the 3D print industry, in which they now track 180 companies producing 3D printers.

Now you might be thinking that this is too small, as there are certainly hundreds, if not thousands of companies producing 3D printers. That’s absolutely true; there are thousands of desktop 3D printers on the market, so many that it is more or less impossible to keep track of them all.

However, Basiliere’s report focuses only on “enterprise-class 3D printer providers”, which produce and market large-scale machinery for industry. Now that number of 180 companies seems a lot larger than you may have thought.

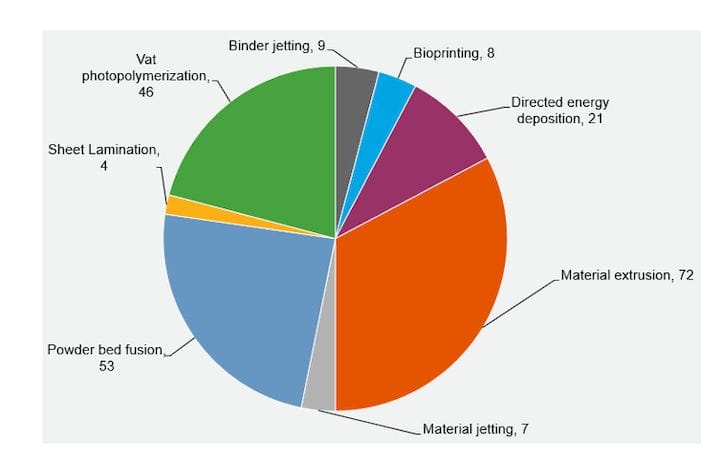

Who are these companies? Well, you’ll have to obtain the full Gartner report to find out, but in the image above we can see the breakdown of the myriad of 3D printing technologies being offered by these 180 operations.

As you might expect, the most popular technologies are based on some of the oldest 3D printing methods: material extrusion, powder bed fusion and vat polymerization. This is likely because the original patents on those 3D printing process have expired, opening the door to new market entrants leveraging those processes.

It’s likely these three categories will be highly competitive, as a major factor for differentiation among participants will be pricing. Good for users, maybe not so good for the companies.

Meanwhile, there are a number of other, newer 3D printing processes that have far smaller representation on Gartner’s list, likely because of still-in-force patents.

Gartner’s thought on why there are so many companies represented on their list is that they still believe there is a vast amount of growth possible, simply because so many companies have not yet engaged with the technology, and those who have engaged have not yet fully deployed the technology. In other words, there is lots of room for growth and thus many market entrants competing for a piece of the action.

I believe the company count statistic represents a bookend on the 3D printing consumer craze, where many small companies entered the market attempting to sell inexpensive — but flawed and purposeless — desktop 3D printers to consumers. That market crashed as consumers, manufacturers and investors realized it wasn’t going to work.

Those that remained in the market worked towards another more profitable market: industry and enterprise. These statistics clearly show that the action in 3D printing is truly in that space to stay.

Via Gartner

A research thesis details the incredibly complex world of volumetric 3D printing. We review the highlights.