Charles R. Goulding and Preeti Sulibhavi examine 3D printing put to use in vacuum cleaner design.

From Dust into Air: Vacuum Cleaners

What probably comes to mind picturing a vacuum cleaner, if you are not a millennial, is a bulky, corded machine with lots of parts in constant need of replacement. Today, that is not so much the case. In the past a vacuum needed a motor, cord, wand, hose, power-head, brush-roller, headlight, belt, filters, cyclone, and if sophisticated enough – attachments.

The working principle behind the traditional, canister vacuum cleaner is utilizing a centrifugal fan that, by rotating, makes air flow by adding kinetic energy. Air is sucked from behind and pushed forward with pressure so negative pressure is created behind the fan.

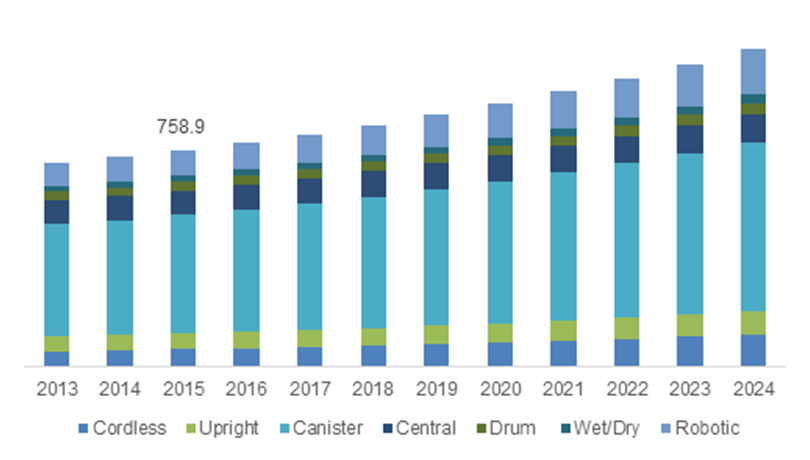

Today, as the price has risen, the size of the vacuum has shrunk. They are lighter, sleeker in design and come with detachable parts, which requires less servicing). While the technology has become more streamlined, the basic principle remains the same. Demand for vacuums has not diminished either. The uses for vacuum cleaners remain the same: cleaning, dusting, finding lost items, inflating air mattresses, deodorizing, and clearing dryer vents at times.

To create these new, sleeker and more intricate parts, major companies such as Dyson and Whirlpool can utilize 3D printing for creating vacuums as well as for creating parts. The parts can be designed with more precision and weigh less as well. With less bulk, vacuum cleaners can become more ergonomic, which becomes essential to housekeepers and to mature, aging populations.

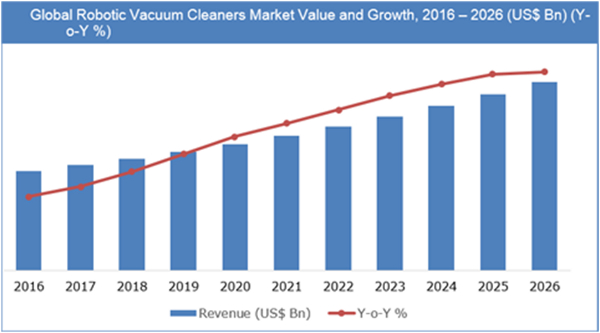

In addition to traditional vacuum cleaners, there are robot vacuum products, like the Roomba or Neato, which have complicated filters and sensors that 3D printing could more precisely create. 3D printing could also help reduce the cost of such robot vacuum cleaners, which are currently expensive. Companies such as Dyson, Whirlpool, Roomba and Neato, etc., can also benefit from R&D tax credits as they innovate.

Major Vacuum Cleaner Manufacturers: Increasing 3D Printing Initiatives

Recently, Dyson expanded its 3D printing and additive/advanced manufacturing capabilities to SUNY New Paltz. The Dyson Foundation awarded $500,000 to the Hudson Valley Advanced Manufacturing Center (HVAMC) at SUNY New Paltz in 2018. The funds can be used to purchase 3D metal printing, wax printing and continuous-build equipment. The award includes an investment in a direct metal printer, which fabricates metal parts and structures at a fraction of the production cost of previously available technology. The funds come just as HVAMC is preparing to relocate to the College’s Engineering Innovation Hub. The Hub is currently under construction and will be completed in 2019.

Whirlpool, Electrolux, Dyson, etc., have the infrastructure and well-established manufacturing procedures that can integrate 3D printing. In fact, Electrolux currently offers 3D model vacuums online. Electrolux has just announced that it is spinning off its large kitchen equipment business to support more of a focus on improved vacuum technology.

3D Printing and Robot Vacuums: Leaving the Competition in the Dust

Vacuum robots that are 3D printed could be capable of more air suction, with more robust construction and well-designed sweepers, dust chambers and roller brushes. Such robot vacuum products often detect obstacles and sudden drop-offs; they tend to “map-out” the area with their sensors, which is how they select the direction to move in.

Utilizing 3D printing in vacuum cleaner design and production provides engineering benefits as well as economic rewards in the form of R&D tax credit incentives that can help fuel future innovation, leaving the competition in the dust.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.