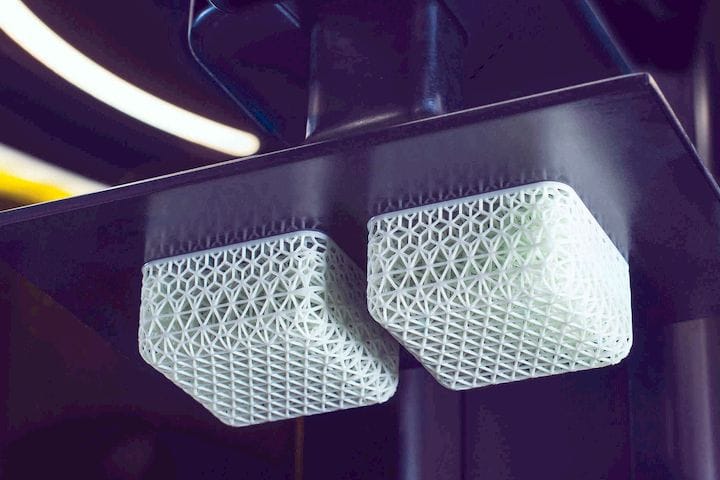

![A 3D print made from Carbon’s EPU material - now at reduced cost [Source: Carbon]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0a2c4676d2.jpg)

In a surprise announcement, Carbon reduced the price of three of their most popular 3D print resins.

The resins, EPX 82 (epoxy), EPU 41 (elastomeric polyurethane), and RPU 70 (rigid polyurethane), are now priced at only US$50 per liter. This is a considerable discount over their initial price of around US$300 per liter in 2016, which had already dropped to half that level; cutting the price again now makes a big statement

Carbon says that the key to the price reduction is volume:

“This radical resin price reduction is made possible by the huge growth in resin demand from Carbon’s customers’ high-volume production applications, and it marks the beginning of the transformation of the 3D printing world from an estimated $10B marketplace to a multi-hundred-billion-dollar, digital manufacturing juggernaut.”

Carbon Co-Founder Philip DeSimone adds:

“We are announcing that our materials are dropping from $150 to $50/L. Our competitors have been in business for 30 years and over that time no one has been able to drive down costs of materials (roughly remaining the same price over that time frame) because no one has been able to get to production at scale.”

I find this development quite intriguing, because for some time we’ve been looking for this pricing breakthrough to happen. While many 3D print operators have become accustomed to high resin prices, typically US$100-200+ per liter, the actual price should be considerably lower.

A few years ago we spoke directly with one of the few worldwide manufacturers of photopolymer resin, who suggested that it should be possible to reduce pricing down to levels as low as USD$10 per liter eventually. At that time we were told the typical cost of materials for resin was about US$7.50 per liter, so at sufficient volume one could expect pricing around US$20 per liter.

That is a far cry from the US$200 per liter often found for proprietary 3D printing resins. Part of that price difference is due to the effects of low volume, but some is certainly due to the monopolistic effects of using proprietary resin by the 3D printer manufacturer.

Regardless of how Carbon did this, it will have a significant effect on the market, and in particular Carbon’s market.

For several years Carbon has been pursuing the manufacturing market directly, unlike most other resin 3D printer manufacturers who continue to pursue the prototyping market. Carbon has been reasonably successful in attracting several key product manufacturers to use of their equipment and materials, most notably Adidas’ FUTURECRAFT shoes.

However, one of the important things to note is the price of the FUTURECRAFT shoes, which are at premium levels. While some of that price is undoubtedly due to the thrill factor, some is also certainly due to the price of production – a large part of which would be taken up by the cost of the 3D printing materials.

Now Carbon has reduced that price considerably. While this reduction may not result in cheaper FUTURECRAFT shoes, it almost certainly opens up additional business cases for a large number of manufacturing opportunities.

Consider the case of a typical manufacturer being pitched the idea of 3D printing production components by Carbon. The manufacturer would, as is good practice, price out the cost of production. At high resin costs, that equation would frequently work out negatively, where the cost of production might exceed the cost the product could bear in the market.

But if the resin cost is much lower, the cost of production is lower and more 3D printed products could quickly emerge.

And that is precisely what Carbon is hoping for: more clients producing more 3D printed products.

I think they will succeed.

The announcement hit this week at formnext, where Carbon is exhibiting in Hall 3.1, booth H30.

Via Carbon

The fate of major 3D printing conferences in 2020 is unclear with the ongoing virus outbreak. We have thoughts on what it could mean.