![[ Source ]](https://fabbaloo.com/wp-content/uploads/2020/05/US-Mex1_img_5eb0a806a7d04.png)

Charles Goulding and Tricia Genova of R&D Tax Savers discuss auto parts 3D printing and the impact of the US/Mexico trade treaty.

As U.S. Secretary of the Treasury Steven Munchen commented after negotiators for the U.S./ Mexico treaty reached agreement businesses always prefer certainty to uncertainty and the new North American agreement contains Bright Line Auto Parts content requirements. To qualify for duty-free treatment the combined U.S./Mexico parts requirement is raised to 75% from 62.5%. Secondly, the new trade rules drive higher wages requiring that 40-45% of content be made by workers earning at least $16.00 per hour. The 3D printing industry should study the new North American content requirements and help the auto industry understand that 3D printing can be an integral part of the cross-border auto parts trade process. In the United States R&D tax credits are available to support new and improved 3D printed parts and processes.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Nissan and Honda and Tier Parts Suppliers

The North American auto manufacturers that are poised to benefit the most from US/Mexico trade planning are those with a substantial presence in both the U.S and Mexico. Also, those that already have global 3D printing expertise should be able to move quicker on these 3D printing business improvement initiatives. For the purposes of this article we have focused on Nissan North America and Honda North America because of their large manufacturing plant footprints on both the U.S. and Mexico sides.

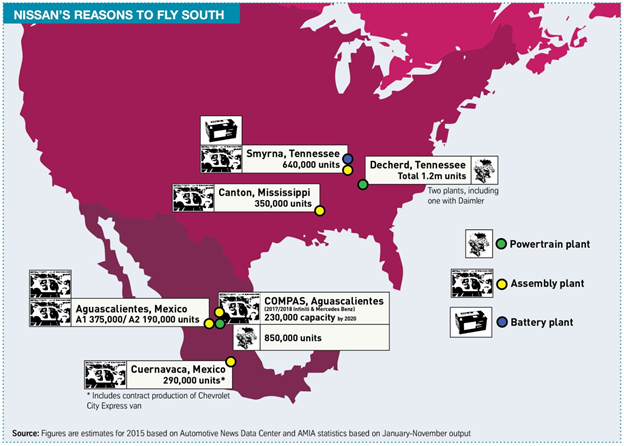

Nissan North America

Nissan has had a Southern Tier U.S and Mexico geographic focus which reduces logistics costs between its Mexican and U.S. plants and suppliers. Nissan has the largest U.S. vehicle assembly plant located in Smyrna, Tennessee at 5.9 million sq. ft. and a large plant in Canton, Mississippi. Both Smyrna and Canton are supported by a large supplier network that is co-located at both facilities. Co-location may enable Nissan suppliers to utilize 3D printer centers of excellence. Nissan is the largest vehicle seller in Mexico.

Honda North America

Honda U.S.’s 2018 Digital FactBook provides the details of its large manufacturing base in the United States including Marysville, Ohio 3.9 million square feet (sq. ft), East Liberty, Ohio 1.9 million sq. ft. and Anna, Ohio 1.6 million sq. ft. Honda also has an extensive Mexico plant in portfolio which is described in detail in the below excerpt from the 2018 Honda FactBook.

Honda Mexican Plant Facilities:

![[Source: Honda 2018 Fact Book]](https://fabbaloo.com/wp-content/uploads/2020/05/US-Mex2_img_5eb0a807101c9.png)

The state of Ohio has an extensive 3D printing support center including major centers at the Ohio State University OSU Tech Hub, the Ohio University Russ College of Engineering center and the Youngstown Center for Additive Manufacturing.

OEM and 3D Printing

The OEM (Original equipment manufacturer) auto manufacturers are in reality final vehicle assemblers and the majority of the underlying components are supplied by Tier 1, Tier 2 and Tier 3 parts suppliers that are referred to as the Tiers. To obtain the benefits from the new U.S. /Mexico treaty the OEMs will need to work with the Tiers so the Tiers are comfortable making the 3D printing investments that will be mutually beneficial.

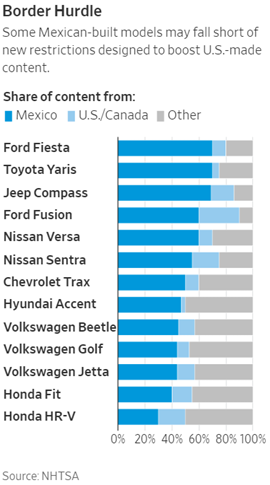

The Tier suppliers can provide higher valve production parts and materials and by utilizing 3D printers and hybrid machine tools/3D printers. The below table illustrates some of the new content hurdles faced by the OEMs.

3D Printing Business Treaty Planning Example

An example would be presuming a U.S. Tier 1 supplier makes one high value component and a Japanese supplier makes another adjacent high value component. The Tier 1 U.S. supplier proactively approaches the U.S. OEM and says, “I can help your treaty compliance by using a 3D printer to integrate the two high value auto part components into one enhanced product,” thereby eliminating the Japanese supplier. This new solution would result in a better integrated component that will helping the OEM meet the new higher North American value percentages required under the treaty.

Conclusion

Constantly improving 3D printing technology should have an important role to play in U.S./Mexico treaty planning. The 3D printing industry should consider focusing on improved applications for Tier high value auto parts suppliers. The new treaty will not become law until ratified by Congress.