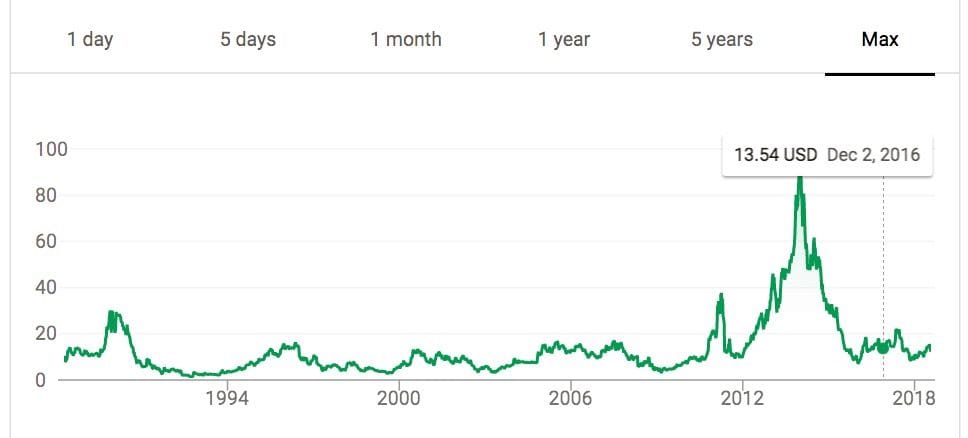

![3D System's stock price over the years [Source: Google Finance]](https://fabbaloo.com/wp-content/uploads/2020/05/dddstock_result_img_5eb0a989df17e.jpg)

I’m reading a piece on InvestorPlace discussing several “doomed” 3D printer company stocks.

At least, that’s what the article states. They say:

There was a time not too long ago when 3D printing stocks were the hottest thing in the market.

But now it’s 2018 and times have changed and they’ve turned from gold to coal. Between DDD, SSYS, VJET, and XONE, all four 3D printing stocks have undergone a peak-to-trough decline in excess of 85% in 5 years.

What went wrong? A few things. Namely, no one actually needed and/or wanted a 3D printer in their home.

More important, will 3D printing stocks remain losers for the foreseeable future? I think so.

Really? I think there is far more to the story.

It’s true that the consumer 3D printing craze was a bust, although it never really started. But in retrospect, it always was: consumer 3D printing was set upon by several parties who used the concept as a means to push up their company’s stock values. They did very well in this respect, and the consumer interest level pushed ALL 3D printer stocks far higher than they should have been.

In 2014/2015 the market corrected and stock prices went closer to where they should have been. As a result there were more than a few unhappy investors, some of whom lost considerable fortunes on the stock price drops.

But behind the “noise” of the consumer 3D printing angle, the industry has been steadily progressing in capability. Many vendors now provide high quality products in the space, today to professionals, designers and engineers, rather than consumers, a similar but smaller market.

Yes, the big 3D print stock companies have been dented by the arrival of new entrants, many of whom are leveraging the expired patents by the big guys. They often provide similar or even better capabilities at lower price levels.

So with all this happening is it time to dump the 3D printer stocks?

I think not. The best time to buy stocks is when they are low. Recall the “buy low, sell high” method, and this could be a case of just that.

The reason I say so is that the two companies most prominent in this situation are 3D Systems and Stratasys. While both of them grew large over decades by leveraging their respective patents, those days are now over and they must compete against those offering similar products and services.

However, both of them seem to be exploring a new unexplored area of 3D printing: large scale manufacturing. 3D Systems has produced their “Figure 4” manufacturing device, which produces unique parts in rapid time through significant automation. Stratasys, meanwhile, has developed a series of fascinating demonstrator machines each targeted at large scale production.

Large scale production is definitely not a big revenue component for either company today, but it could be. Manufacturing, as HP tells us all too often, is a USD$12T (yes, “T”) market. Even a small slice of that would make either company quite large.

The problem is how to integrate into existing production systems and provide unique capabilities. I believe both companies are indeed making moves that head in that direction. For example, Stratasys has partnered with manufacturing expert Siemens on a number of topics.

The competitors to these companies tend to be smaller and unfamiliar with large scale manufacturing, so there is an opening for Stratasys and 3D Systems, with their expertise, connections and cash to make a transition to those markets.

But back to the question of investment. I’d say these two stocks would be ones for a long term strategy; if successful in transition, they could become enormously successful. Yes, it’s a bit of a bet, but it could be a good one.

Via InvestorPlace