With Solidworks’ announcement of an integrated manufacturing network, questions arise regarding the future of existing community making networks.

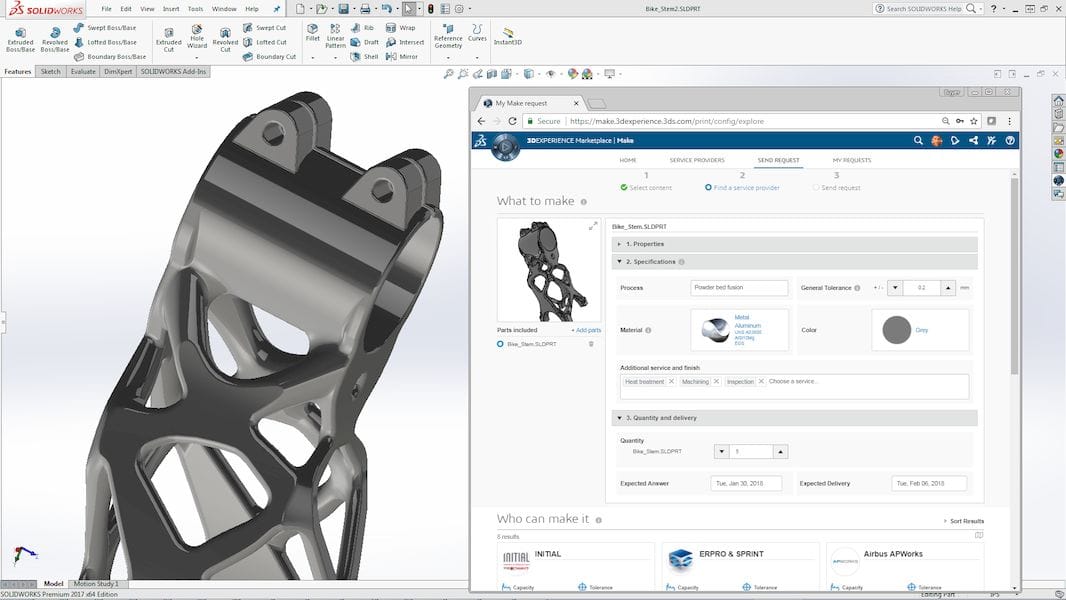

Solidworks’ new “3DEXPERIENCE Marketplace Make” provides a way for any manufacturing service to plug directly into Solidworks’ ecosystem. From their tools you can send designs to workshops for immediate production. You’ll be able to work with the manufacturing providers on an iterative basis to refine the design to perfection, all with a cloud-saved usable audit trail of discussions and decisions.

The providers in the “Make” service can provide a wide variety of making services, including CNC, Laser, Finishing and, important to us, 3D printing.

The intention seems to be to make Make a deeply integrated service such that not only 3D files move between parties, but also directly integrated transactions, such as connections between ERP (financial and business) systems. Integrations like that would be incredibly valuable to big companies, who otherwise would have staff chasing down all manner of administrative stuff after the fact. This is especially true when you realize that Make provides not only 3D printing, but ALL types of manufacturing. A company need only get ALL of their admin stats from one service, Make.

Because of this, it seems likely many print-buying companies may sign up just to get the administrative advantages. This is quite sticky for Solidworks, as it implies everyone in the value chain would have to buy into Solidworks’ vision.

Today there are a several operations that provide services similar to Make, including MAKExyz, 3D Hubs and even Xometry. 3D Hubs began as a community 3D print network, but recently switched to a more broad manufacturing base.

What are these companies and similar to do, given the announcement of Solidworks’ Make? This appears to be a very direct competitive threat to them.

Even worse, it seems that Make might provide far deeper integration as described above, a capability that others are unlikely to be able to provide as they are perhaps too small to take on the significant work involved.

I fear they now face a stiff uphill climb to compete with the giant Solidworks in this market.

There is one possibility I might suggest.

Solidworks’ competition also faces challenges with this announcement. With the presence of Make, it could cause some businesses to switch to Solidworks to gain the advantages mentioned, to the detriment of alternate 3D CAD providers. One of the biggest companies in this position would be Autodesk.

Here is one crazy idea: maybe Autodesk should acquire, say 3D Hubs, or one of the other making networks, and build it into their equivalent of Solidworks Make? It would be a relatively quick way to for them to catch up, or at least try to.

One way or the other, times will certainly be very interesting for making networks in the next year.