A report from Germany shows an unusual development from a major firm demanding use of 3D printing.

The report by Peter Van der Zouwen of DigiFabster, an online quoting system we covered last year, covered the happenings at an event held in Berlin by Deutsche Bahn. If you’re not familiar with “DB”, they happen to be the national railway in Germany, a massive company carrying over 2 billion passengers a year, with revenues exceeding USD$42B.

This is a company with thousands of engines and railcars, and you can imagine the effort required to maintain their network. They employ thousands and obviously have a very significant repair operation. One that no doubt requires huge numbers of spare parts.

It’s that inventory that’s at question here. According to Van der Zouwen, DB’s objective at this session was this:

This was really something new: Instead of suppliers pitching their innovative 3D printing technologies, a huge customer telling its suppliers to move with the times and adopt Additive Manufacturing.

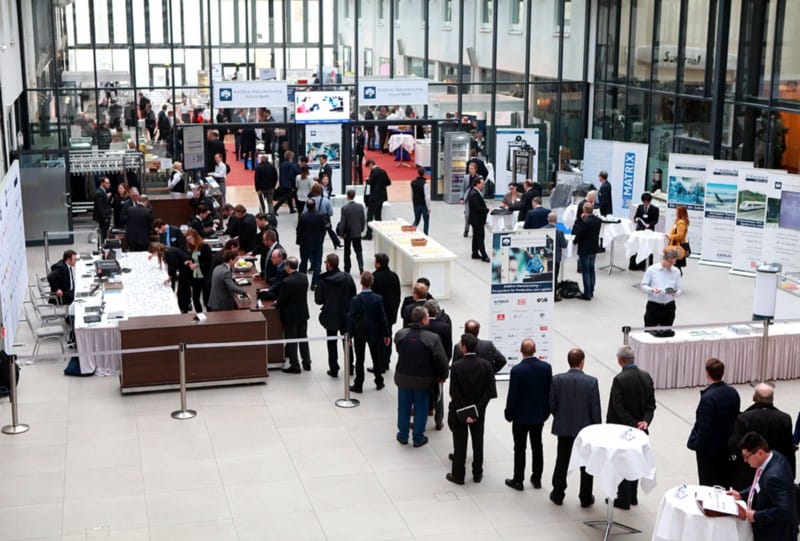

Venue was the Estrel Congress & Messe Center Berlin, host was Deutsche Bahn (DB), represented by their “Mobility goes Additive” group, and the invitees were traditional SME’s in machine building. DB had brought some of their friends, like Airbus, Alstom and Audi (and those are only the “A”’s) to help convince everybody else that they really, really, really would like shorter delivery times and smaller series so as to bring down their spare parts costs.

Evidently DB spends the astonishing sum of €500M (USD$530M) per year on spare parts and they’d like to reduce this through the use of 3D printing technologies.

The idea is that instead of the incredibly expensive traditional process of pre-buying and stocking a wide variety of spare parts in multiple warehouses, perhaps it would be more effective to “print” them on demand. Why? Because although the part cost might be greater per part, you avoid the costs of storage, which are considerable. Van der Zouwen complains they did not break out this portion of their costs in the presentation, but I’m sure it is significant.

This is a topic of growing interest. We recently wrote on the notion of transportation companies fundamentally changing their approach to spare parts with the introduction of production-quality 3D printing technology. More recently Forbes published a story along the same lines, although they are playing it more as bad news for the spare parts supply chain.

Van der Zouwen’s report goes on to suggest they may have been unsuccessful in presenting their case to their vendors and that they may have best focused on some other aspects. It’s a good read.

My observation here is the curious flow of information. Instead of the usual case of innovative suppliers trying to persuade a conservative buyer to consider some new approaches, we have the exact opposite: a progressive company is whacking their suppliers to get up to speed with the latest technologies.

What does this mean? It means in the manufacturing industry, we likely have a great deal of companies reluctant to try new things. So many that a major buyer had to formally ask them to make a change.

To me this situation implies there are enormous opportunities for manufacturing suppliers to investigate, and by ignoring them, they leave themselves vulnerable to more progressive companies who take some risks to develop new approaches.

Who are those progressive companies and what might they achieve? Maybe you should start one!

Via DigiFabster