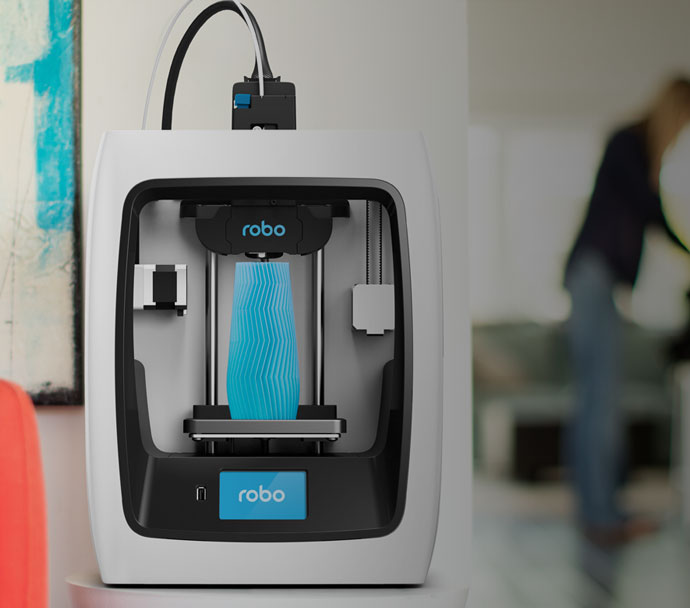

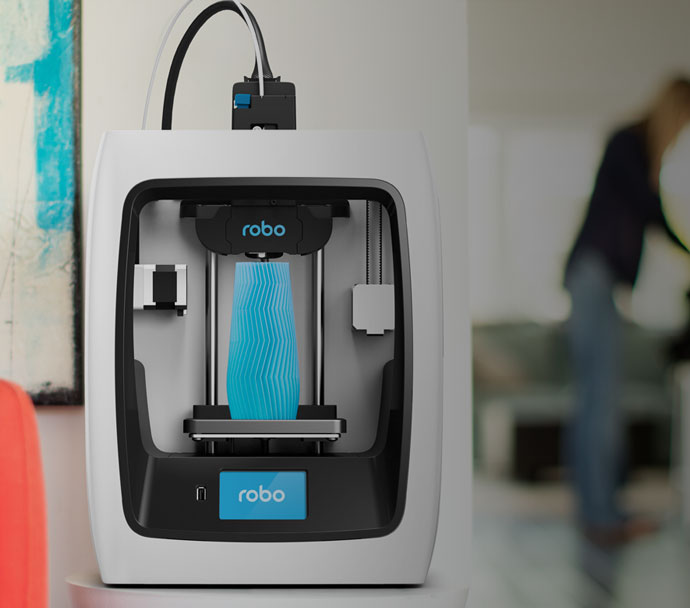

There’s now another publicly traded desktop 3D printer company that you can buy shares in: Robo.

This week the company completed their IPO (Initial Public Offering) on the Australian Securities Exchange (ASX), and the results were quite spectacular for the startup 3D printing company.

It’s very challenging for small companies to get to this state, as they usually need to grow significantly before having the capacity to go through the rather arduous and costly process of IPO’ing.

However, Robo found an unusual method of doing so that we described a few months ago: they made arrangements to be bought by an obscure Australian mining company. The secret here is that this mining company was ALREADY listed on a stock exchange, thus enabling Robo to “inherit” the work already done.

Now the news is that the stock has opened for trading on the ASX. Essentially, Robo (or actually the holding company, Falcon Minerals) is selling of a chunk of their stock to the public through the exchange. The funds paid by stock buyers goes directly to the bankroll of the holding company, and of course, Robo 3D.

Typically, when a stock is set for debut on an exchange, a price is set for the shares that are made available as part of the transaction. For this IPO, the expected stock price was USD$0.07 per share, but unexpectedly when the ASX opened, the stock rose to USD$0.11 per share a 57% premium over the expectations.

This premium is very interesting. It is a signal that the public is more interested in 3D printing stocks – or at least this particular one – than some analysts believed. It’s a sharp change in attitude after a few years of doom and gloom for 3D printing investments, and may foretell of an upcoming swing in stock prices of other companies in the industry.

This all resulted in a huge USD$6M windfall for Robo and its shareholders. The company now has a very substantial bank on which they can execute their future plans.

It sounds like the company wishes to focus on the education market, as have some other desktop 3D printer manufacturers. But with the USD$6M, they’ll no doubt be able to achieve progress smaller companies would not be capable of.

We will certainly find out more in a few weeks when we sit down with Robo chief Braydon Moreno at CES.