A new infographic portraying recent 3D printing industry corporate mergers prompts me to talk about the reasons why these things happen.

Corporate mergers are certainly a thing in the world of 3D printing, although there have been a lot fewer recently for a variety of reasons.

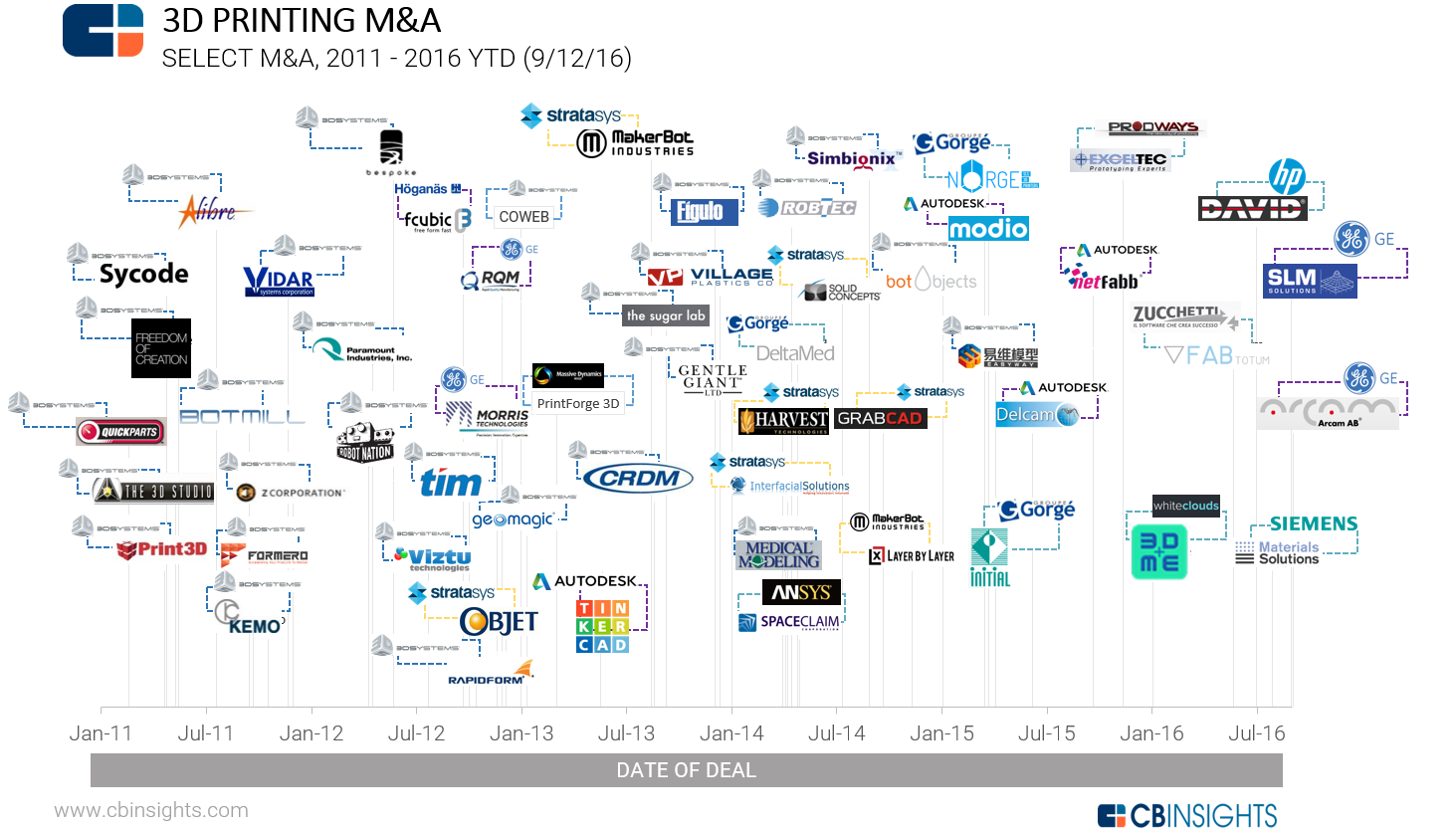

In the past, however, there have been dozens of corporate actions. At one point, 3D Systems was acquiring at least one or two companies every month! Their activity was so pervasive that we published two analyses on Stratasys and 3D Systems’ corporate mergers.

Now CB Insights has taken much of the same data and prepared an infographic showing some of their acquisitions, and the acquisitions of a few other smaller 3D print companies as well. Here is a full resolution view of the infographic:

While it may seem like a routine event, each of these corporate moves is very carefully considered and the reasons behind them are varied. Some of the most typical rationales include:

- Acquiring a complementary product that fills in gaps in the acquiring company’s product line

- Acquiring a specific technology that can be leveraged by the acquiring company in their products

- Acquiring talented staff, scientists, managers that can help the acquiring company make better stuff

- Acquiring access to a larger distribution network to enhance sales of products from both companies

- Acquiring a hot product at a small stage before it eventually eats the acquiring company’s products

- Acquiring a portfolio of active patents that the acquired company wasn’t leveraging

But there’s another reason, perhaps more devious, that could have been the driving force behind many acquisitions in recent years. In the run up of 3D printing stocks in the 2010-2015 period, 3D Systems in particular was acquiring many companies that seemingly had no benefit; there was sometimes no fit to any of the items above.

One of their acquisitions never made any sense to me: their January 2015 acquisition of BotObjects, a company purporting to make a full color 3D printer, but whose mysterious marketing practices led many to believe their product wasn’t real, including me.

In retrospect, it now appears they may have been simply acquiring companies before they either went bankrupt or caused some other distressing news in the 3D print industry. In other words, 3D Systems could have been attempting to ensure only “good news” in the industry so as to keep their stock price from taking a hit, slight or otherwise.

That was certainly a legal approach, but perhaps for some it may have been ethically questionable. Nevertheless, 3D Systems no longer has that strategy – it seems to have been completely extinguished last year with the change in CEO at the company.

When a merger happens, it’s always a good idea to ask “why?”

Via CB Insights