While perusing recent patent filings by the major 3D printing companies, I noticed something rather strange.

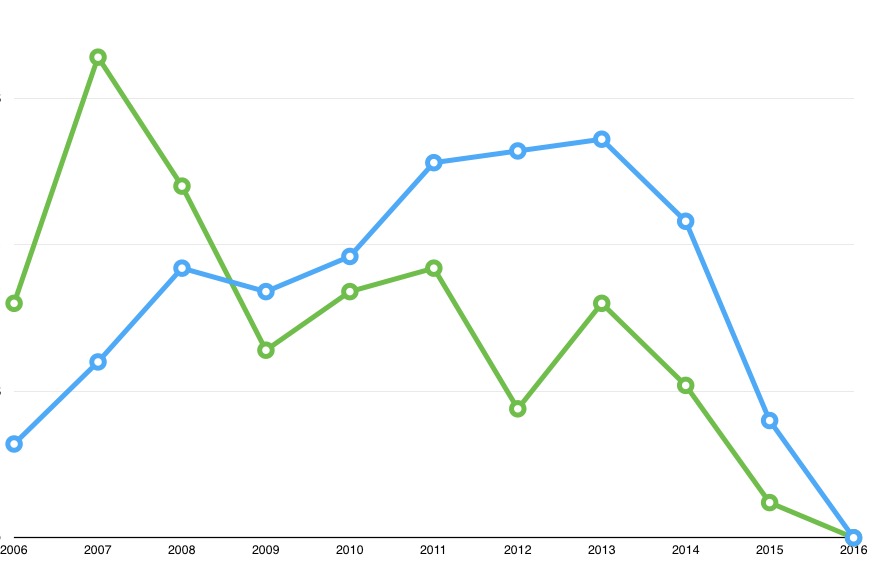

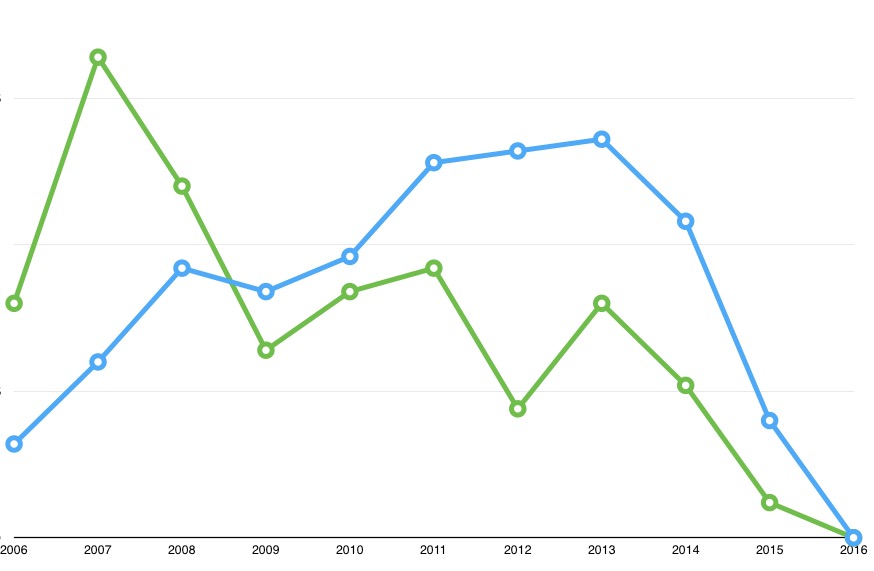

Please refer to the chart above, which shows total US patent filings by two key companies in the 3D printing world, 3D Systems (Green line) and Stratasys & Objet (Blue line). Note that these are “filings”, which are different from approval of the patent applications, which can happen years later. These charts essentially show the output of the research being done by the companies, as their work most likely would culminate in a patent filing.

Do you see what I am seeing?

Let’s look at the blue line, Stratasys, first.

The number of filings increased gradually from 2006, peaking in 2013, than falling off very sharply, with a very low number appearing last year – and literally zero this year so far, and we’re more than one quarter through the year.

Now the green line, 3D Systems.

Here we see a very large number of applications in 2007, but then the line slopes dramatically downwards with only a few filings last year and, like Stratasys, none this year so far.

What can we make of this? Some speculative ideas:

Perhaps more research was being done when stock prices, income and corporate enthusiasm were higher in other years. From what I can tell, it seems the peak of enthusiasm would have been in early 2014, but in the case of 3D Systems, their filings tailed off long before then.

For Stratasys, the filings did drop after 2014, suggesting this scenario might be the case for their company’s research activities. Less cash flow equals less research. Certainly that’s likely the case today with 3D Systems as well, but it doesn’t explain their previous drop off years earlier.

There’s another more insidious possibility: the two companies could be running out of innovative ideas for 3D printing.

That’s a very dark concept, especially when many people consider 3D printing as an infant technology just getting started.

But it may indeed be the case within the technology scope of each company. Their patents, by and large, are focused around their existing technologies and knowledge.

Perhaps this indicates their existing foundational technologies have become so mature there’s little left to advance?

If that’s the case, we could expect either of the companies to shake things up by acquiring other companies with fundamentally different technologies they can build upon in coming years.