A new report from CONTEXT provides estimates for sales for the leading companies in 3D printing, from which we can draw some interesting conclusions.

Their report shows a 33% rise in sales revenue for desktop 3D printer units over the past year, but a decrease in revenue for industrial 3D printers by 9%.

These figures seem to resonate with my observations and anecdotal discussions with vendors. Many vendors, particularly the smaller players, cite large growth, but some of the larger vendors are being quiet about their recent performance.

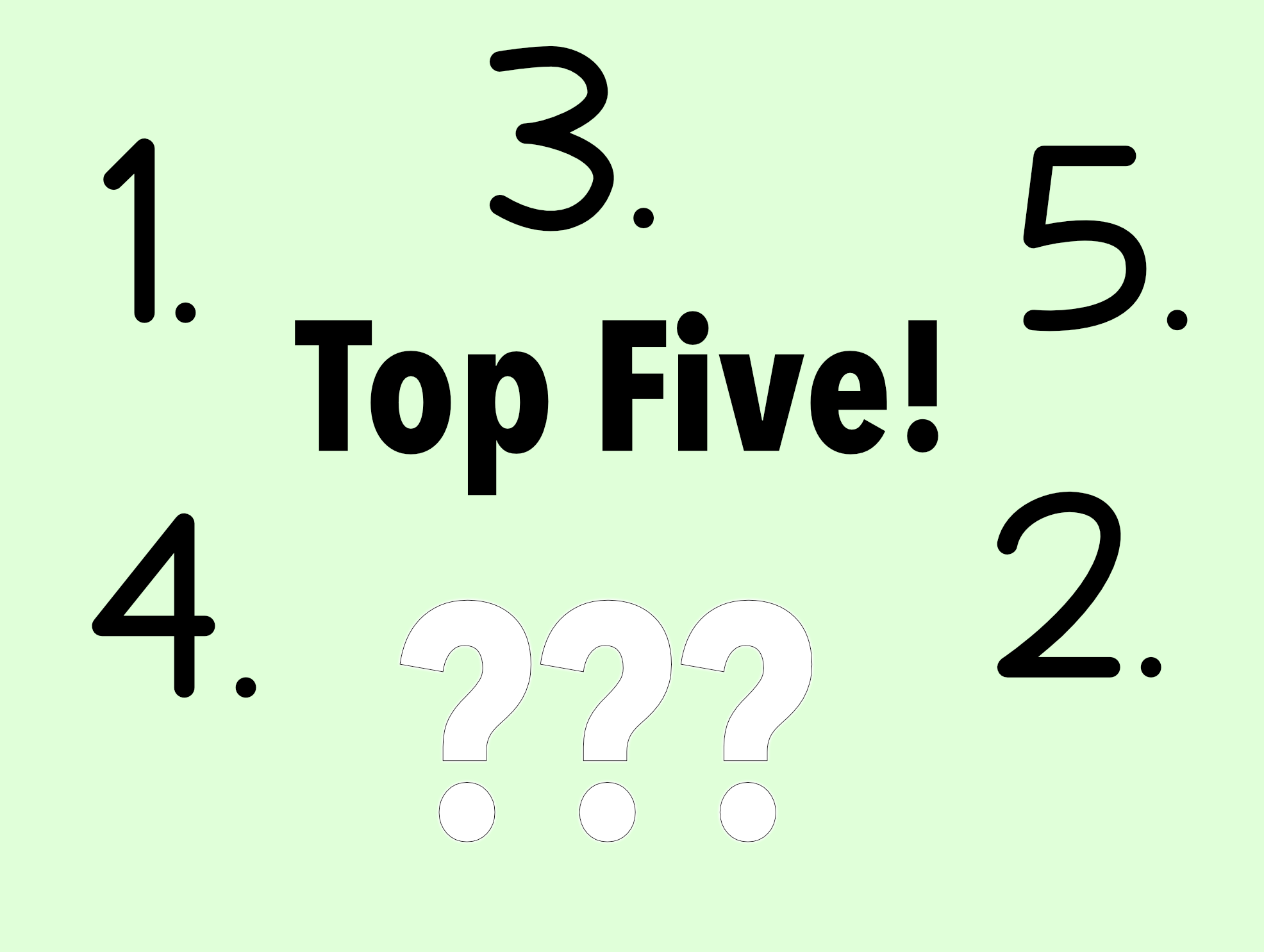

But who are the leaders? Let’s look at their first chart, which shows the top five desktop 3D printer vendors for the final quarter of 2015 and the entire year 2015:

Observations here:

- XYZprinting is far, far in the lead. Their sales are more tan the next four players combined, at least for 2015Q4.

- Almost half of XYZprinting’s units were sold in the final quarter of 2015 – meaning they’ve had an incredible rise in sales somehow, perhaps through opening up to new retailers and distributors.

- 3D Systems drops out of the list for 2015Q4, but evidently still sold a substantial number of units earlier in 2015 before they abruptly shut down their consumer division.

- http://www.fabbaloo.com/blog/2015/12/29/breaking-3d-systems-kills-the-cube-and-cubify

- Stratasys (or really MakerBot as they are the desktop unit) drops off the list in 2015Q4 after selling perhaps 15,000 units earlier in the year. This is just before they announced the new SmartExtruder+ that addressed customer complaints about the Replicator 5th Gen. I expect them to pop up in the 2016Q1 list because of this change.

- Two other companies, M3D, a lower cost unit, and Ultimaker, appear in the list as consistently selling units year-round.

- This chart shows unit sales, not revenue. To estimate revenue, you’d have to multiple the units by the average sale price, which would have somewhat different results. While XYZprinting would still be on top due to their huge sales, Ultimaker likely pops in at the second position due to their more expensive units.

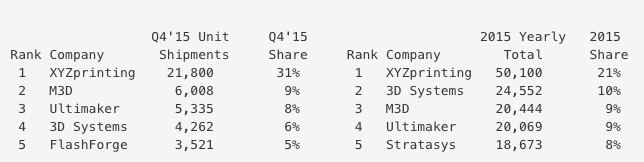

This chart shows the sales of industrial, not desktop units. Some observations:

- Stratasys is far in advance of the next player, 3D Systems, with literally half the market in terms of units sold.

- MCOR, once a startup company, now shows as a serious contender with significant sales, likely assisted greatly by their recent ventures into new markets.

- envisionTEC is a solid seller in their markets with 10% of unit sales.

- Those not appearing on the list must have dramatically lower unit sales, perhaps only dozens per quarter or less. This includes some of the publicly traded companies – and also some of the more expensive units.

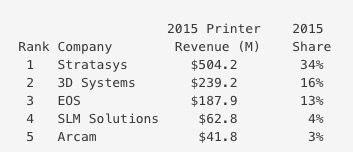

Which leads us to the final chart, which shows revenue from 3D printing companies in 2015, not unit sales. Observations:

- Arcam appears on the revenue top five, but not in the top five unit sales, indicating their machines are priced at higher levels than others.

- Stratasys is in the lead, but not half the market as they were in unit sales. This suggests their average machine price is less than 3D Systems, who are solidly in second place.

- Positions three through five are occupied by companies delivering metal 3D printers, a capability increasingly sought after this year.

The leaders of 3D printing today, as least when measuring sales, seem to be XYZprinting and Stratasys.

Via PRNewsWire