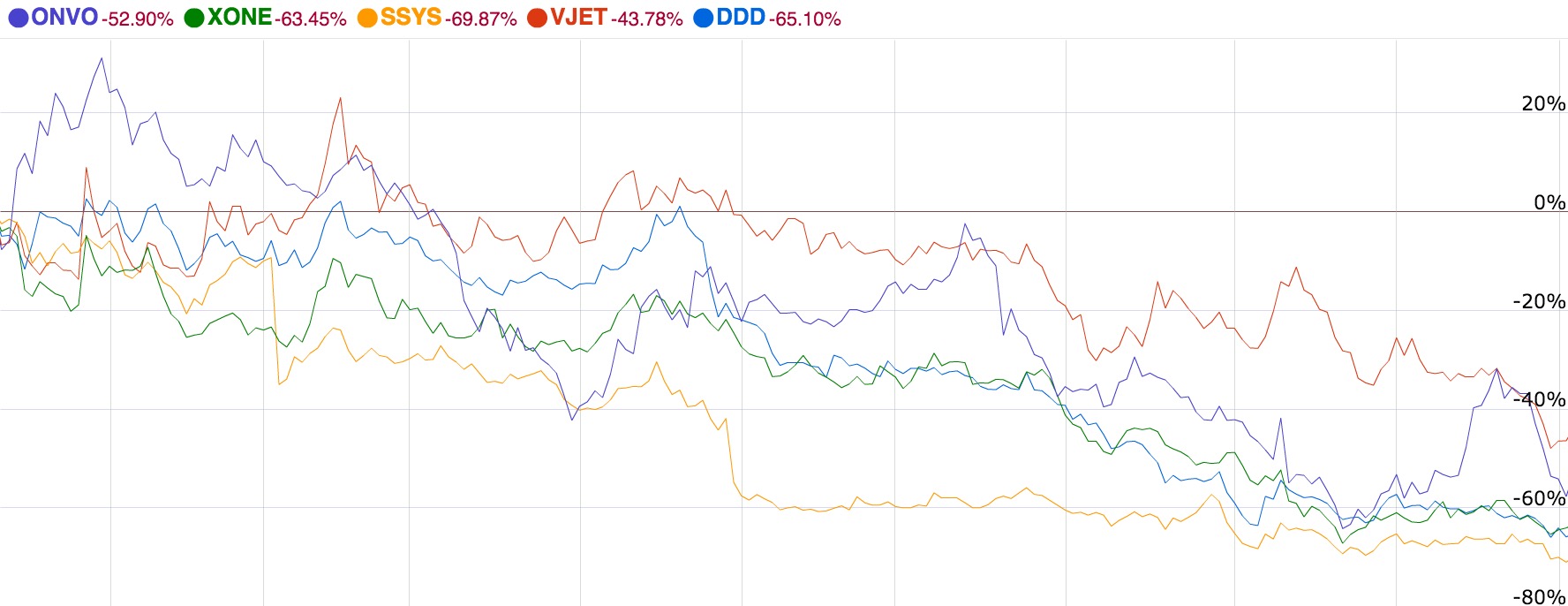

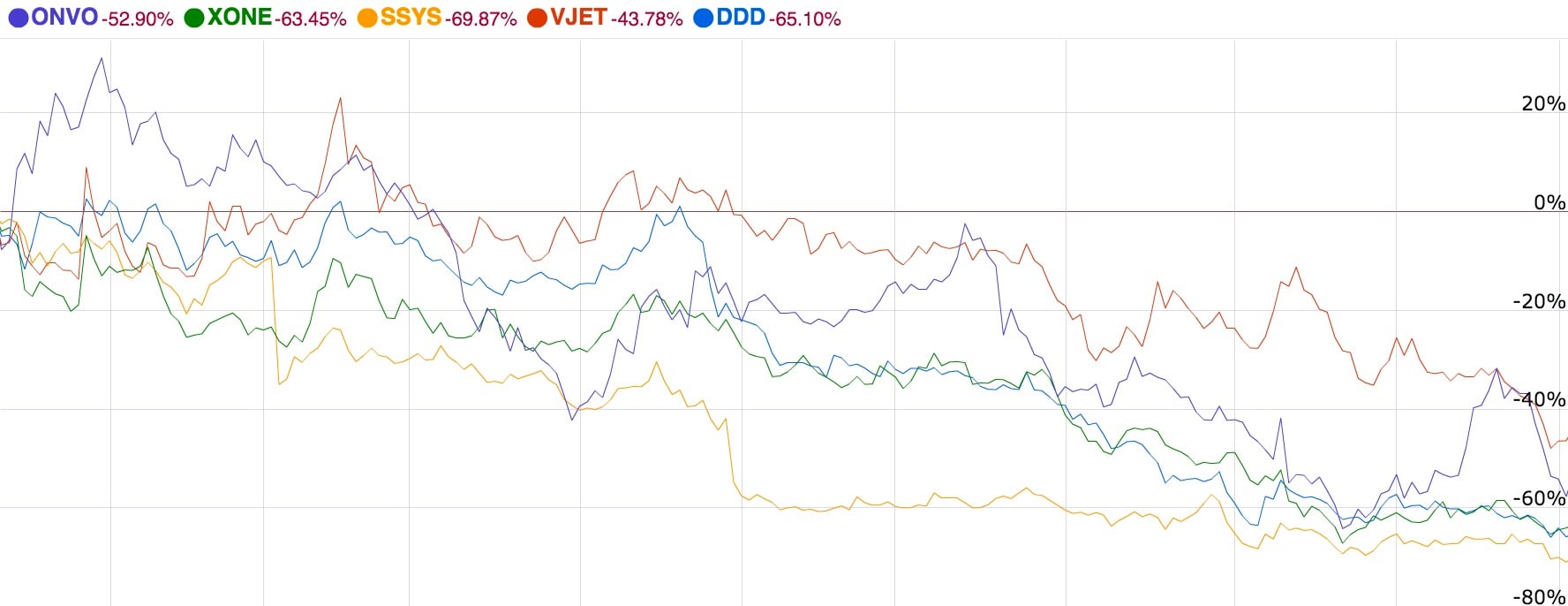

We’re reading a damning article from Investor Guide, which issues dire predictions for the 3D print industry.

The story suggests that 3D printing stocks will continue to degrade and the author strongly recommends “shorting” these stocks. “Shorting” is the practice of buying options that make money if the related stock loses value in the future. it’s kind of like betting on failure.

The author feels that while company “turnarounds” can be quite profitable, there is little likelihood of that happening in 3D printing:

A turnaround is a rare phenomenon and investors should be very cautious while buying a stock that appears cheap. As for 3D printing stocks like 3D Systems (DDD), Stratasys (SSYS), Voxeljet (VJET), ExOne (XONE), and Organovo (ONVO), I still think these stocks are not good turnaround candidates. In fact, I believe the whole sector still has more room to fall, which is why I’d recommend investors to short these stocks.

Why is it felt that 3D printing is not going to turn around?

Over the last few years, I have highlighted multiple shortcomings of the 3D printing technology. These include high time consumption, poor quality, high price, etc. While 3D printing has improved a little over the last two years, the technology still has those shortcomings. In addition, these are a few additional flaws that I haven’t thrown light on before like high energy consumption, and unhealthy air emissions. Studies have shown that 3D printers consumer about 50 to 100 times more electricity than conventional machines. This further adds to the cost of manufacturing any product via 3D printing. Moreover, a study the Illinois Institute of Technology shows that 3D printers can have substantial emissions of potentially harmful nanosized particles in indoor air.

And:

These two factors will further restrict the widespread adoption of 3D printers in industrial as well as consumer segment. So, while the 3D printing stocks may appear cheap, the prospects of the technology are still dim.

We feel this analysis is quite shortsighted, as there is continued real growth in 3D print companies, particularly in the industrial segments, less so in consumer markets. The reason stock prices are “down” is simply because they were boosted overly high by speculative investors who in recent years wanted to get in on the magical technology of “3D Printing”.

The stock prices will tend, overall, to follow the hype cycle for 3D printing, of which we’ve written several times. The hype cycle predicts there will be a downturn in interest in 3D printing as uninformed investors and observers discover the technology wasn’t quite what they thought.

Meanwhile, the technology is the same: many people continue to discover new uses, companies continue to education industry on proper and effective use and increasing numbers of consumers learn more about 3D and 3D printing. Over time the use of 3D printers will solidify and grow steadily. Only then will speculative investors realize the true value of the technology.

Is it time to short stocks? No, we think it’s time to buy stocks. While there may yet be a slight dip, the long term industry growth will eventually raise the stocks.

Via Investor Guide (Hat tip to Greg)