An article by Wyatt Investment research got us thinking about the future of stock plays in the 3D printing area.

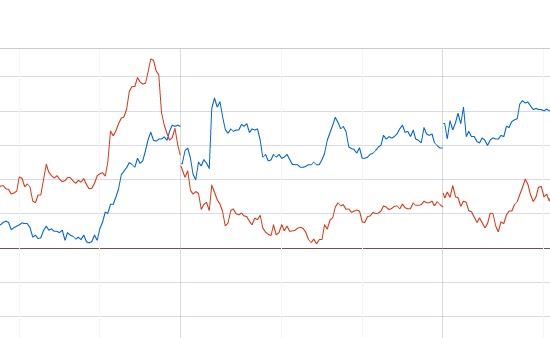

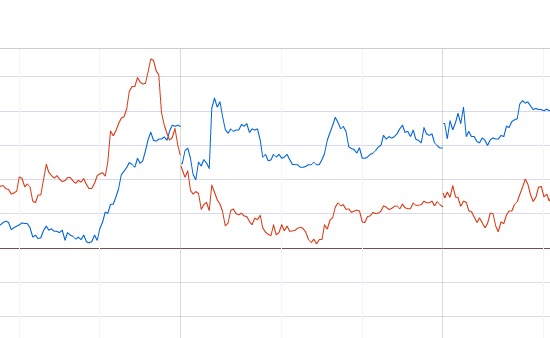

The article suggests that current publicly traded 3D printing stock companies are still priced too high, even after their dramatic fall last year. They suggest more profits could be found by investing in the future.

We tend to agree. 3D printing is still an industry in flux. We have numerous smaller players (almost universally not publicly traded) who have yet to demonstrate huge growth. We also have a handful of larger, more mature companies, some of which are indeed publicly tradable. It’s these companies that suffered stock price drops as overly-hyped investors discovered that 3D printing is not quite what they thought it might be.

While the existing large players continue to incrementally improve their businesses, there are a couple of things happening in left field that may affect how this scenario plays out. If HP’s mysterious new printing process works, or if Carbon3D’s revolutionary super-fast process is taken up by the market, then we could see significant changes in stock values for all 3D printing companies.

It could be a time to wait it out, investment-wise, for now until the picture becomes a bit clearer. On the other hand, an aggressive investor might take a position in some of the lower priced options before they (potentially) take off in the future.

Via Wyatt Investment Research (Hat tip to Greg)