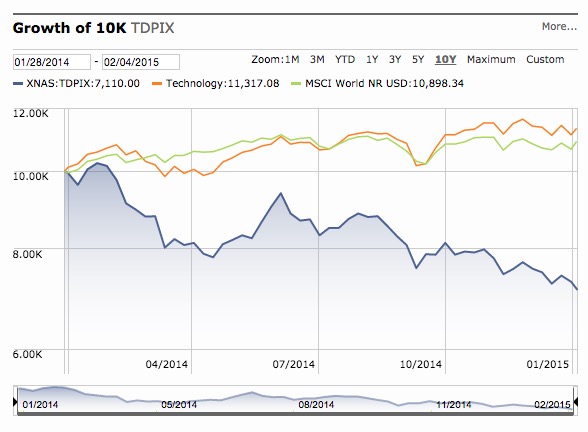

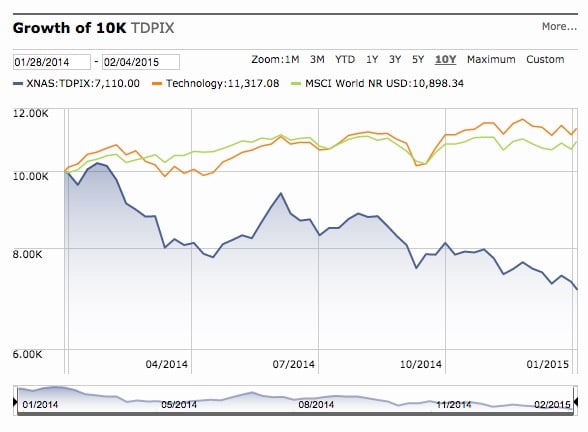

A mutual fund focusing on 3D printing technology has struggled over the past year.

Set up in 2014, the 3D Printing and Technology Funds appears to have dropped in value since their inception.

There are two similar funds offered by the 3D Printing and Technology Fund, TDPIX and TDPNX. While both are “indexes”, which represent a basket of stocks related to the industry in question, the two funds have differing entry requirements. TDPIX, for institutions, requires a minimum of USD$100,000 to invest, while the TDPNX’s requirement of USD$2,500 is suitable for individual investors.

The problem is that these funds are composed of the very few 3D printing stock companies available at the moment: Stratasys, 3D Systems, Autodesk, Dassault Systems (Solidworks) and the like. These companies are now experiencing a backlash from the public whose overly-inflated expectations of the technology are being deflated as they discover what the tech can and cannot do.

Both 3D Systems and Stratasys stock values have dipped this past year, but it’s important to keep something in perspective: these companies had unbelievably huge growth in price in previous years. Ten years ago, for example, Stratasys’ stock price hovered around USD$14 before skyrocketing to as much as USD$136 at the end of 2014. The others have had similar rides.

The problem for these funds is that they entered the market just as the stock values decreased. If they had been started even a year earlier they’d be up slightly. Had they been started two years earlier, they’d be heavily in the money.

The lackluster performance has affected the size of these funds as well, having a mere USD$2.9M in assets, which sounds to us rather small for a mutual fund.

For investors in these funds, it’s a case of deciding to cut your losses and move on – or holding and hoping 3D printing stocks grow in value as 3D printing technology usage grows over the longer term.

That would be our choice. Because it’s gonna happen.

Via Morningstar and 3DP Fund